You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

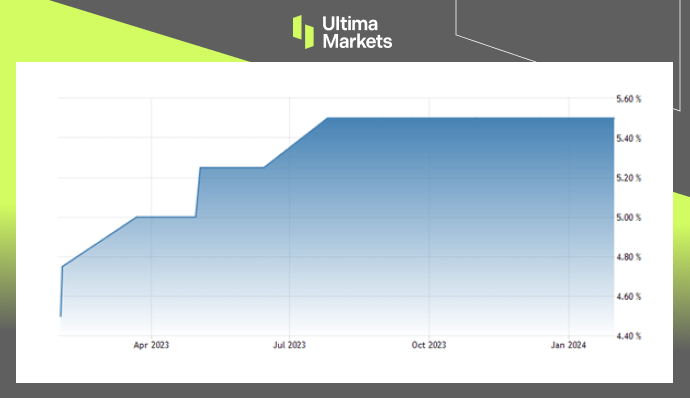

In the January meeting, the Federal Reserve (FED) opted to maintain Fed funds rate at 5.25%-5.5%, holding steady at its 23-year high for the fourth consecutive meeting, aligning with expectations. Policymakers conveyed that they are hesitant to lower rates until they are more confident in inflation sustainably approaching 2%.

During the press conference, Fed Chair Powell indicated the likelihood of rate reduction sometime this year but emphasized that decisions will be made on a meeting-by-meeting basis, expressing skepticism about a cut in March. Simultaneously, the Fed omitted references to potential rate hikes in its statement, citing improved balance in the risks associated with achieving employment and inflation goals.

However, the Fed emphasized readiness to adjust monetary policy if emerging risks threaten those objectives. The central bank acknowledged a slight easing of inflation over the past year but highlighted that it remains elevated. Consequently, the US dollar strengthened and rebounded above 103.5 levels, while the US 10-year Treasury yield hovers near 2-week low of 3.97%.

Nonetheless, selling pressures hit stocks. During Wednesday’s trading session, Dow Jones fell by 0.82%, the S&P 500 went down by 1.61%, and the Nasdaq Composite plunged by 2.23%. All 11 sectors of the S&P concluded in the red territory, with communication services, technology, and energy leading the selloff.

(Fed Fund Rates)

(Dollar Index Six-month Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4