You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

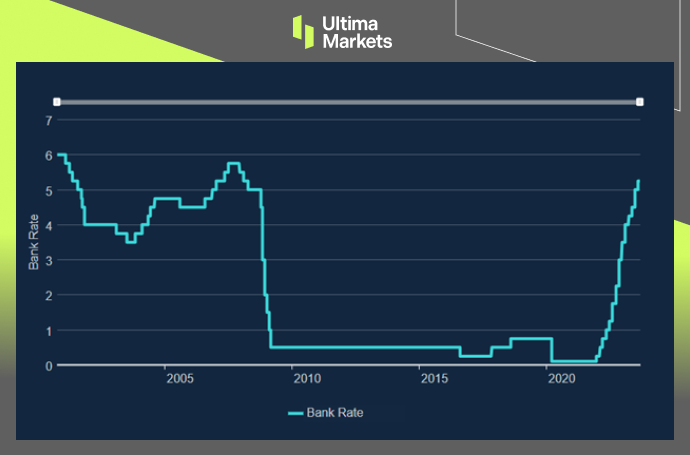

UK Rate Hikes Reached A Plateau

Bank of England Governor Andrew Bailey said at a Treasury Select Committee hearing on the 7th that the interest rate hike policy is close to the peak, and BoE’s Monetary Policy Committee will make another decision on September 21.

The Announcement

Britain’s annual inflation rate of 6.8 percent is higher than Prime Minister Rishi Sunak’s planned target of 5 percent by the end of 2023 and is the highest among G7 nations.

The governor explained that due to the increase in crude prices, the inflation data in August may be slightly higher than expected. At the same time, he believes that inflation will be obvious by the end of this year, especially in autumn.

In addition, he pointed out that the Monetary Policy Committee may finally vote in support of raising interest rates in September.

(Bank rate record, Bank of England)

Economic Insights

The Bank of England released a monthly survey on the 8th, showing output prices are expected to increase by 4.9% in the next 12 months. The figure, based on a three-month rolling average, was down 0.5 percentage from July and well below last year’s peak of 6.6% in September.

The outlook for wage growth has also dropped to an average of 5.1%, continuing a downward trend from a high of 6% in late 2022. The survey of recruiters points out a cooling labor market. The findings could slow the central bank’s pace of raising interest rates.

Conclusion

In conclusion, it’s evident that the United Kingdom is currently facing a challenging economic situation with a persistently high inflation rate and signs of a cooling labor market. The comments made by Bank of England Governor Andrew Bailey and the data from the recent survey have sparked discussions about the future of interest rates and economic stability.

As we move forward, it’s crucial for individuals and businesses to monitor these developments closely, as they have the potential to impact various aspects of the economy. Whether you are a trader, investor, or simply someone interested in economic matters, staying informed is the key to making well-informed decisions in these uncertain times.

Remember that financial markets can be volatile, and it’s advisable to seek professional advice and conduct thorough research before making any significant financial decisions. As we await the upcoming decision by the BoE’s Monetary Policy Committee on September 21, the economic landscape in the UK remains a topic of great interest and importance.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Vì sao chọn giao dịch Kim loại & Hàng hóa với Ultima Markets?

Ultima Markets cung cấp điều kiện giao dịch và chi phí cạnh tranh hàng đầu cho các mặt hàng phổ biến trên toàn thế giới.

Bắt đầu giao dịchTheo dõi thị trường mọi lúc mọi nơi

Thị trường dễ bị ảnh hưởng bởi những thay đổi về cung và cầu

Hấp dẫn với các nhà đầu tư chỉ quan tâm đến đầu cơ giá

Thanh khoản sâu và đa dạng, không có phí ẩn

Không qua môi giới tạo lập thị trương, không báo giá lại

Khớp lệnh nhanh chóng thông qua máy chủ Equinix NY4