You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

CAD Bounced, But Appreciation Capped

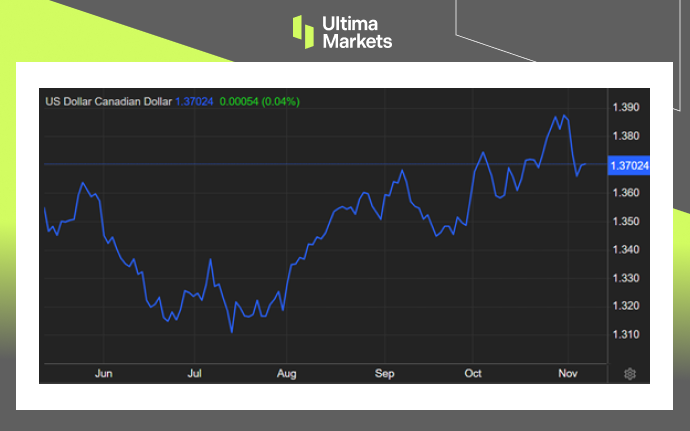

The Canadian dollar has strengthened to 1.37 per USD, bouncing back strongly from the one-year low of 1.39 reached on November 1st.

This recovery was strengthened by a general retreat in the DXY index, as weak economic data from the US reinforced the Federal Reserve’s indications that they may hold off on further interest rate hikes.

However, the appreciation was limited by disappointing domestic economic data, which increased expectations of a less aggressive stance by the Bank of Canada (BoC).

(USD/CAD Six-month Chart)

CAD Resurgence: Unveiling the Drivers

The rebound in the CAD is primarily driven by external macroeconomic factors:

DXY Index Retreat: The decline in the DXY index, which measures the USD’s strength against major currencies, is a pivotal factor.

This decrease in USD strength is linked to weak economic data from the United States, reinforcing the Federal Reserve’s inclination toward a more prudent approach to interest rate hikes.

This decline in USD strength has provided essential support for the CAD’s appreciation.

Domestic Economic Headwinds: Understanding the Constraints

The CAD’s upward momentum is hindered by domestic economic challenges:

- Rising Unemployment: Canada’s unemployment rate surged to 5.7% in October, the highest level in 21 months. This unexpected increase has raised concerns about the stability of the Canadian labor market.

- Sluggish Wage Growth: The ongoing deceleration in wage growth is a significant issue. Slower wage growth affects consumer spending and economic sentiment, adding to uncertainty in the market.

- Faltering Job Creation: Job creation in Canada has fallen short of expectations, highlighting a pronounced weakness in the labor market. The inability to meet job creation projections amplifies concerns about the overall health of the Canadian economy.

Bank of Canada’s Approach: Navigating Economic Waters

The role of the Bank of Canada is paramount in shaping the CAD’s trajectory:

- Interest Rate Policy: In a recent meeting, the BoC opted to maintain unchanged interest rates. However, the central bank has expanded its flexibility regarding future rate hikes. This shift indicates the BoC’s concern about the repercussions of previous tightening measures.

- Dampened Demand and Inflation: The BoC has recognized that previous rate hikes have curbed demand and restrained inflation. This suggests a more measured approach to monetary policy, striking a balance between stimulating economic growth and managing inflation.

Conclusion: An Insightful Perspective

To sum up, the CAD’s resurgence from a one-year low is underpinned by a complex interplay of external and domestic factors.

While the retreat of the DXY index and the Federal Reserve’s policy stance have buoyed the CAD, the constraints of a challenging labor market and the BoC’s nuanced policy approach remain substantial challenges.

Staying vigilant in monitoring these factors is vital for investors and businesses as they navigate the intricate financial landscape.

Vì sao chọn giao dịch Kim loại & Hàng hóa với Ultima Markets?

Ultima Markets cung cấp điều kiện giao dịch và chi phí cạnh tranh hàng đầu cho các mặt hàng phổ biến trên toàn thế giới.

Bắt đầu giao dịchTheo dõi thị trường mọi lúc mọi nơi

Thị trường dễ bị ảnh hưởng bởi những thay đổi về cung và cầu

Hấp dẫn với các nhà đầu tư chỉ quan tâm đến đầu cơ giá

Thanh khoản sâu và đa dạng, không có phí ẩn

Không qua môi giới tạo lập thị trương, không báo giá lại

Khớp lệnh nhanh chóng thông qua máy chủ Equinix NY4