You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

PBOC Holds Rates Steady, Disappointing Market Expectations of Further Easing and Sparking Broad Selloffs

TOPICSTags: LPR, People's Bank of China

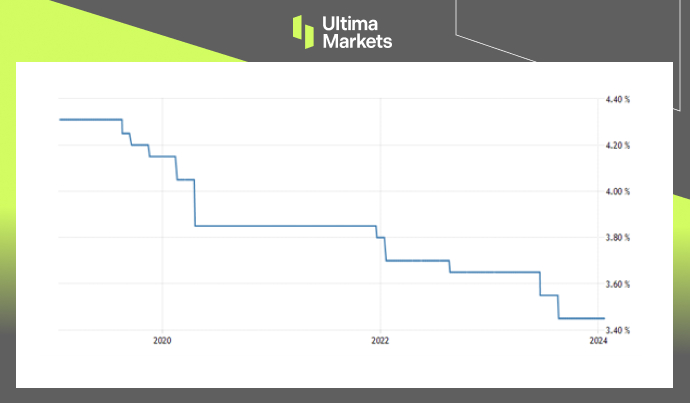

The People’s Bank of China (PBoC) decided to keep its lending rates stable in the January setting. The medium-term lending facility, known as the one-year loan prime rate (LPR), used for corporate and personal loans, stayed at a historic low of 3.45% for the fifth month in a row. The five-year rate, a benchmark for mortgage rates, remained at 4.2% for the seventh month consecutively. Last week, the central bank notably increased liquidity injections through medium-term policies while unexpectedly maintaining the interest rate, leading to the decision on Monday. Despite growing faster than the previous quarter at 5.2% year over year in 2023’s fourth quarter, the Chinese economy fell short of the predicted 5.3%. The GDP saw an overall annual expansion of 5.2%, outpacing the government’s roughly 5.0% target and speeding up from a 3.0% increase in 2022, thanks to various supportive measures and a low base effect from last year.

(China Loan Prime Rate,PBoC)

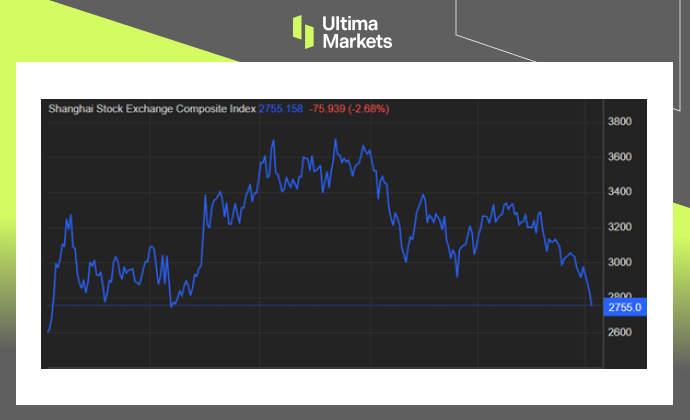

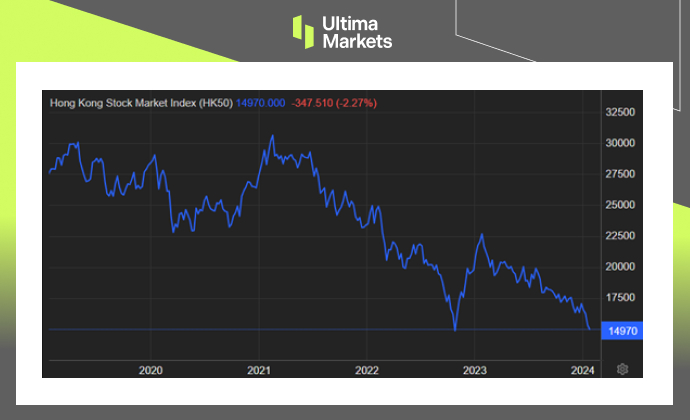

On Monday, the Shanghai Composite fell by 2.68%, settling at 2,756, while the Shenzhen Component plunged by 3.5% to 8,480. Mainland stocks hit new multiple-year lows as China’s central bank maintained its primary lending rates steady, which contradicted the market’s anticipation for additional policy relaxation. The Hang Seng also experienced a downturn, with a decline of 2.27% as all its sectors witnessed pullbacks.

(Shanghai Composite Index 5-year Chart)

(Hang Seng Index 5-year Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Vì sao chọn giao dịch Kim loại & Hàng hóa với Ultima Markets?

Ultima Markets cung cấp điều kiện giao dịch và chi phí cạnh tranh hàng đầu cho các mặt hàng phổ biến trên toàn thế giới.

Bắt đầu giao dịchTheo dõi thị trường mọi lúc mọi nơi

Thị trường dễ bị ảnh hưởng bởi những thay đổi về cung và cầu

Hấp dẫn với các nhà đầu tư chỉ quan tâm đến đầu cơ giá

Thanh khoản sâu và đa dạng, không có phí ẩn

Không qua môi giới tạo lập thị trương, không báo giá lại

Khớp lệnh nhanh chóng thông qua máy chủ Equinix NY4