Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Japan’s Retail and Industrial Production Data Mixed, Yen Appreciated on Expectations of Monetary Policy Change

In the ever-evolving sphere of global economics, Japan’s financial landscape remains a focal point of interest. As we navigate through the intricacies of Japan’s retail and industrial sectors, we are presented with mixed data that fuels discussions and influences global market dynamics.

In this comprehensive analysis, we explore the recent surge of the Japanese Yen, the resilience of the retail industry, and the complexities of industrial production in Japan.

Japanese Yen Rose on YCC Anticipation

The Japanese yen appreciated against the U.S. dollar, reaching its highest level in nearly 3 weeks. The uplift was brought by the Japanese media reporting that the BOJ may change the monetary policies on Tuesday.

Understanding the BOJ’s Yield Curve Control

The BOJ adapts the yield curve control in an attempt to influence interest rates. The report said the central bank may allow long-term interest rates in Japan to rise. Specifically, it might let interest rates on 10-year government bonds go above 1%.

Last time, BOJ tweaked its yield curve control in July from 0.5% to 1%. Higher interest rates tend to make a currency more valuable to investors. As a result, the possibility of Japan raising rates helped make the yen stronger compared to the dollar.

(USD/JPY One-year Chart)

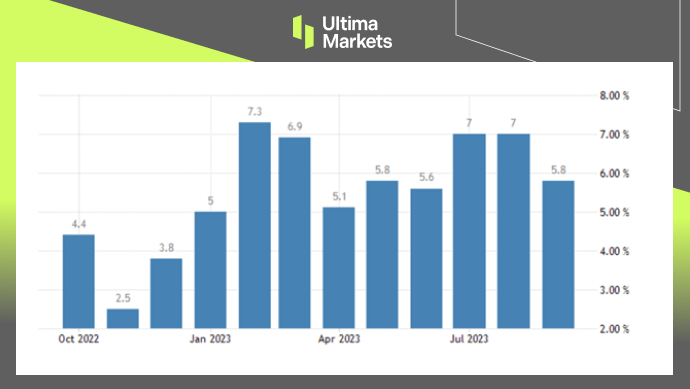

Japanese Retail Sales Recovering from Pandemic

Retail sales in Japan rose 5.8%YoY in September. This is a slower increase than the 7% jump in sales seen in both July and August. The September gain was about in line with forecasts expecting a 5.9% rise. Still, it marked the 19th month in a row that retail sales have grown in Japan. This shows consumer spending continues to recover after dropping during the pandemic.

(Japan Retail Sales, METI Japan)

Insights into Consumer Spending Recovery

This continuous growth in retail sales reflects Japan’s steadfast commitment to economic recovery, particularly in the face of the challenges posed by the global pandemic.

It underscores the unwavering nature of consumer spending, even after a significant drop during the early stages of the pandemic.

The retail sector’s ability to adapt and thrive in challenging circumstances showcases Japan’s economic resilience.

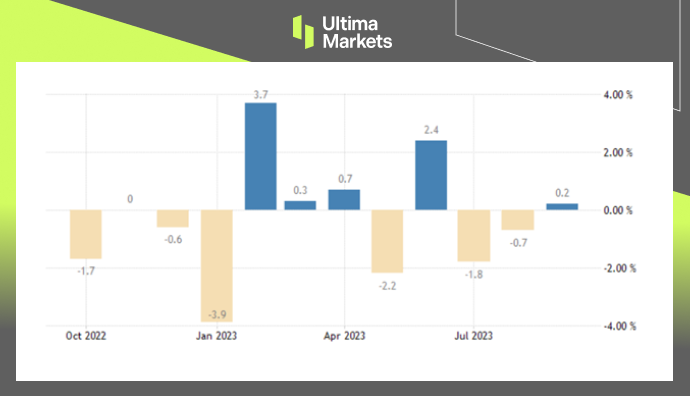

Japan’s Industrial Production Fell Short of Expectations

In September, Japan’s industrial production experienced a modest growth of 0.2% compared to the previous month. However, this figure fell short of market expectations, which had predicted a 2.5% increase.

The September result represents a turnaround from the 0.7% decline that was recorded in the previous month. Importantly, this marks the first positive change in industrial output since June.

Factors Influencing Industrial Output

The increase in production was primarily driven by notable improvements in the manufacturing of motor vehicles, which saw a substantial increase of 6.0% compared to a decline of 3.9% in August.

Additionally, there was growth in the production of general-purpose and business-oriented machinery, which showed a 2.6% increase compared to a 1.0% decrease in the preceding month.

However, when considering the annual comparison, industrial output in September exhibited a decline of 4.6%. This follows a 4.4% drop in August and signifies the third consecutive month of contraction in industrial production.

(Japan Industrial Production, METI Japan)

Conclusion

In conclusion, this comprehensive analysis deciphers Japan’s economic landscape, characterized by the Japanese Yen’s notable surge, the resilience of the retail sector, and the complexities surrounding industrial production.

These facets collectively shape Japan’s economic future, emphasizing the crucial role of policy adjustments and market dynamics in determining the nation’s economic well-being. Stay tuned for further insights into the ever-evolving economic terrain of Japan.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server