Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

UK Interest Rates Cut; Financial Stocks Struggle to Resist Selling Pressure

TOPICSTags: BoE, British Pound Sterling, FTSE100

In its August meeting, the Bank of England reduced its Bank Rate by 25 basis points to 5%, aligning with the expectations of a narrow majority of market participants. The cut lowered the benchmark rate from its 16-year high, where it had remained for a full year. The Monetary Policy Committee (MPC) described the decision as “finely balanced,” with four out of nine members opting to maintain current borrowing costs.

The Committee noted that it anticipates headline inflation to decrease and inflation expectations to converge toward the target. Following the rate decision, market participants have escalated their expectations for further rate reductions in the remaining months of the year, anticipating an additional 35 basis points of cuts. However, Governor Bailey cautioned against reducing rates “too quickly or by too much”. His warning stems from ongoing concerns regarding the persistent nature of domestic inflationary pressures.

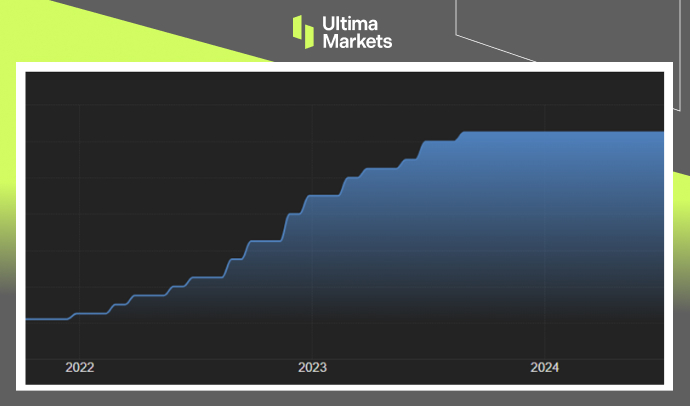

(United Kingdom Historical Interest Rates)

The FTSE 100 closed down 1.01% at 8,283 on Thursday, reversing its earlier gains. The index was heavily influenced by a mix of positive and negative corporate news, with losses ultimately outweighing gains. Meanwhile, GBPUSD dropped below $1.28, reaching a low not observed in approximately a month.

On the positive side, Next surged 8.3% after raising guidance on strong quarterly results. Similarly, Rolls-Royce climbed 7%, also due to raised guidance and strong quarterly performance. The engine maker additionally pledged to reinstate dividends next year.

However, these gains were overshadowed by significant losses in several sectors. Melrose shares plummeted over 12%, bottoming at the index. Despite reporting results above expectations, the company lowered its revenue guidance to £3.8 billion. Schroders also disappointed investors, dropping 9.7% due to underwhelming results.

The banking and financial sector faced broad declines, contributing significantly to the index’s overall loss. NatWest fell 8.1%, while HSBC decreased 6.5%. Standard Chartered declined 6%, Lloyds was down 5.7%, Barclays dropped 4.7%, and Prudential decreased 4.5%.

(FTSE 100 Index Weekly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server