You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Gold Surges Past $2,000 Driven by Geopolitical Tensions

Israeli forces have begun their largest ground attack in Gaza so far in the war with Hamas, despite ongoing diplomatic efforts to delay an expected full ground invasion.

Fueled by hedge buying, Gold raised above $2,000 an ounce and marked the third straight weekly gain.

Gold is trading within a very steep ascending channel, which highlights not only the strength of the current rally but also the need for consolidation.

(Gold Price USD/Ounce)

The Gold Rally: A Closer Look

The Middle East’s developing geopolitical events, particularly the ongoing conflict between Israeli forces and Hamas, are primarily responsible for the recent spike in gold prices.

Israeli forces have launched their most extensive ground attack in Gaza to date, despite continuous diplomatic efforts to avert a full-scale ground invasion.

This significant escalation of hostilities has triggered a sharp increase in the demand for gold, predominantly driven by a surge in hedge buying.

Geopolitical Tensions: The Catalyst

The heightened geopolitical tensions have underscored the importance of gold as a safe-haven asset. During times of uncertainty and conflict, investors and institutions alike turn to gold as a reliable store of value.

The surge in gold prices reflects not only the current rally’s strength but also the market’s demand for a stable and secure asset amidst turmoil.

A Steep Ascending Channel

Gold’s impressive ascent is further emphasized by its trading within a steep ascending channel. This upward price trend signifies not only the robustness of the current gold rally but also the necessity for consolidation.

The ascending channel illustrates the market’s optimism regarding gold’s potential and its sustained upward trajectory.

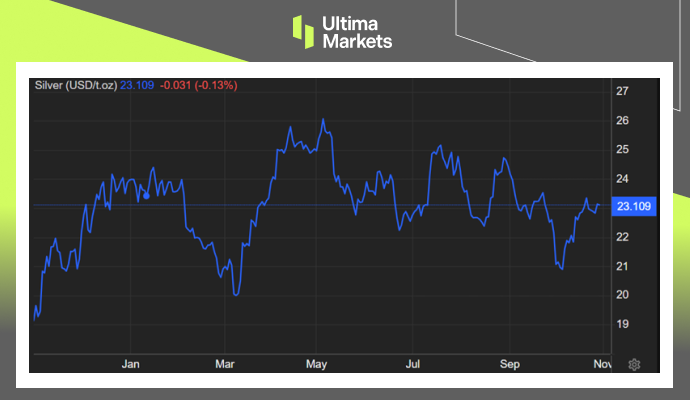

Silver Softened, After Hitting a High

On the other hand, silver, a valuable metal often sought as a safe investment during uncertain times, received ongoing support due to the Middle East conflict.

Additionally, the prospects for increased industrial usage of silver were strengthened by additional stimulus measures implemented in China.

However, silver prices didn’t sustain strength, falling below $23.3 per ounce, following a recent peak on October 20th.

(Silver Price USD/Ounce)

Conclusion

The surge in gold prices, driven by geopolitical tensions in the Middle East, marks a pivotal moment in the precious metals market.

Gold’s status as a safe-haven asset has been reaffirmed, and its upward trajectory within a steep ascending channel suggests a continued bullish sentiment.

While silver also responded positively to global turmoil, its recent price decline highlights the complex dynamics within the precious metals market.

Stay tuned for more updates as we navigate these exciting developments in the world of precious metals.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2023 Ultima Markets Ltd. All rights reserved.

Pourquoi trader des métaux et des matières premières avec Ultima Markets ?

Ultima Markets offre l'environnement de coûts et d'échange le plus compétitif pour les matières premières les plus répandues dans le monde.

Commencer à traderSurveiller le marché en déplacement

Les marchés sont sensibles aux changements de l'offre et de la demande

Attrayant pour les investisseurs uniquement intéressés par la spéculation sur les prix

Liquidité profonde et diversifiée sans frais cachés

Pas de bureau de négociation et pas de requotes

Exécution rapide via le serveur Equinix NY4