You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

TSM Revenue Exploded in October, Market Value Exceeded NT$15 Trillion

THEMENTSM Achieved a Record-high Revenue Last Month

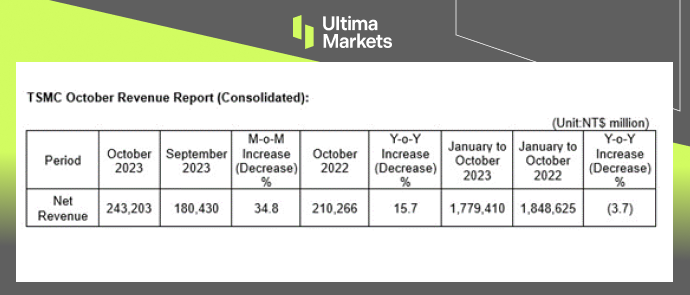

On November 10, Taiwan Semiconductor Manufacturing Company (TSM.US) announced that its October revenue was a record-breaking US$7.53 billion (NT$243.2 billion), representing a notable 34.8% increase from September and a 15.7% raise from the same period last year. Though some customers are still working through inventory adjustments due to weaker global demand, particularly in consumer electronics, TSMC’s cumulative revenue for the first 10 months of 2023 totaled US$55.6 billion, a modest 3.7% decline from the same period in 2022. The strong demand for TSMC’s 3nm technology contributed to its ADR surging more than 6% after earning releases.

Last month, TSMC’s CEO, C. C. Wei, expressed optimism about the chip market, stating that the company anticipated it would reach its lowest point “very soon” following a period of prolonged sluggishness due to the COVID-19 pandemic. The surge in the AI industry has driven an increased need for chips used in training large language models.

In summary, TSMC’s third quarter revenue was driven by its advanced technology, with 3nm, 5nm and 7nm processes accounting for a combined 59% of the company’s total revenue. Looking ahead, TSMC plans to mass produce an even more advanced 2nm process in 2025, which is expected to solidify the company’s position as a leader in high-end technology development.

As for the outlook, TSMC expects fourth-quarter revenue for 2023 to range between US$18.8 billion and US$19.6 billion, with an estimated midpoint of US$19.2 billion (approximately NT$614.4 billion at the exchange rate of NT$32 per US$1). This represents an approximately 11.1% increase quarterly. Despite the expectation that revenue may decrease somewhat in November and December compared to October, TSMC estimates that revenue in the remaining two months will average US$5.84 billion to meet its financial forecast target.

(TSMC Consolidated October Revenue)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Warum mit Ultima Markets Metalle und Rohstoffe handeln?

Ultima Markets bietet das wettbewerbsfähigste Kosten- und Börsenumfeld für gängige Rohstoffe weltweit.

Mit dem handel beginnenÜberwachung des Marktes von unterwegs

Märkte sind anfällig für Veränderungen in Angebot und Nachfrage

Attraktiv für Anleger, die nur an Preisspekulationen interessiert sind

Umfangreiche und vielfältige Liquidität ohne versteckte Gebühren

Kein Dealing Desk und keine Requotes

Schnelle Ausführung über den Equinix NY4-Server