Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

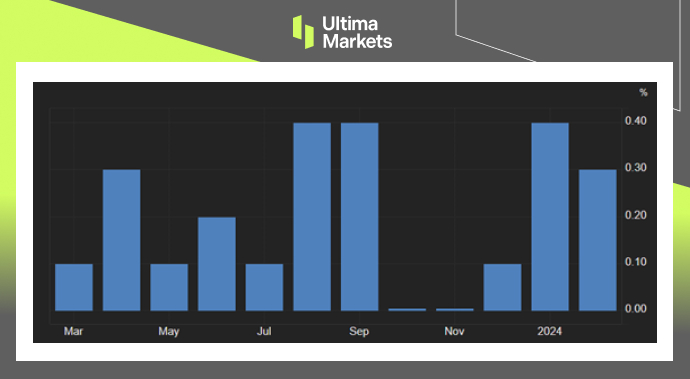

The U.S. personal consumption expenditure price index (PCE) increased 0.3% month-over-month in February 2024. The increase was lower than the upwardly revised 0.4% rise in January and lower than the forecasted 0.4%. Prices for services went up 0.3%, while prices for goods rose 0.5%. The annual rate edged up to 2.5%, in line with forecasts, from 2.4%, which was the lowest since February 2021.

Meanwhile, the monthly core PCE inflation, which excludes food and energy and is the preferred inflation measure by the Federal Reserve, slowed to 0.3% from an upwardly revised 0.5% in January, matching expectations.

Separately, food prices increased 0.1%, and energy prices soared 2.3%. Finally, the annual core inflation rate slowed to 2.8%, the lowest in about three years, from 2.9%.

(PCE Price Index MoM%,U.S. Bureau of Economic Analysis)

In remarks made at the San Francisco Fed, Chair Powell indicated that the PCE inflation data from February aligned more closely with the Federal Reserve’s expectations, which is a positive development. The recent figures may not measure up to the more favorable data seen last year, yet this does not compel the Fed to rush into reducing interest rates. Patience is key, as policymakers can observe greater certainty before considering rate cuts. Chair Powell elaborated that while the Fed anticipates a decrease in inflation as part of their primary scenario, should this not transpire, the willingness to maintain current rates for an extended period is on the table.

As investors pored over a set of economic data during a low-volume Good Friday trading session, the dollar index retreated, slipping below 104.5 on Friday after previously reaching a six-week peak of 104.7.

(Dollar Index Weekly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server