You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Spanish Markets: A Positive Kickstart to 2024

The Spanish financial landscape is off to a promising start in 2024, building on the momentum of a stellar performance in the previous year. Let’s delve into key insights and forecasts shaping the Spanish markets this year.

IBEX 35: A Strong Kickoff

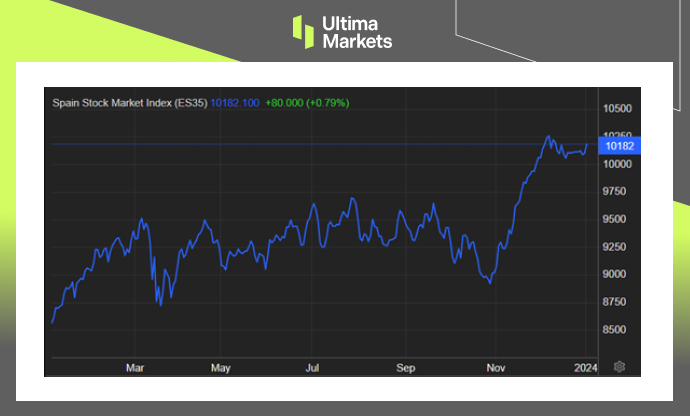

The IBEX 35 (ES35), Spain’s benchmark stock market index, surged to 10,182 on January 2nd, 2024, defying prevailing negative sentiments across European markets. This positive trajectory follows a notable 23% gain in 2023, showcasing resilience and strength in the face of challenges.

(IBEX 35 One-year Chart)

Economic Outlook: Navigating Challenges

As we look ahead, the economic and policy outlook for Spain in 2024 reveals a cooling trend since early 2023. Growth is anticipated to remain subdued initially before gaining momentum later in the year. This cautious optimism aligns with global economic adjustments and the need for strategic policy measures.

Record Bond Sale: €130 Billion Bids

Spain’s fiscal landscape made headlines with a record €130 billion in bids for a bond sale. The offering of 10-year bonds via banks garnered substantial interest, exceeding expectations and signaling confidence in the Spanish market.

Spanish Real Estate: A Year of Transition

The Spanish real estate market is poised for change in 2024. Emerging from a period of sustained growth, the market is entering a new cycle, presenting both challenges and opportunities for investors and stakeholders.

Spanish Stock Exchange: Market Insights

Navigate the Spanish Stock Exchange with comprehensive information on trading hours, market holidays, and early closing dates for 2024. Stay informed about the opening and closing times to make strategic investment decisions.

Market Forecasts 2024: Adapting to Change

Explore market forecasts for 2024, offering insights into Spain’s economic landscape. After years of growth, the context for 2024 indicates a period of slowdown and cooling, presenting challenges that businesses and investors need to navigate.

Spanish Economy: Moderation in Growth

For a detailed breakdown of the Spanish economy’s outlook in 2024, refer to forecasts by CaixaBank Research. Expect the growth rate to moderate to 1.4%, reflecting a nuanced economic landscape with its own set of challenges and opportunities.

Spanish Stock Exchange Holidays 2024

Plan your investment strategy with precision by referring to the list of holidays for the Spanish Stock Exchange in 2024. Knowing when the markets are open and closed is crucial for making informed decisions.

Frequently Asked Questions

Q1: What is the outlook for the Spanish economy in 2024?

A1: The forecast suggests a moderation in the growth rate to 1.4%, indicating a nuanced economic landscape with its own set of challenges and opportunities.

Q2: How did the IBEX 35 perform in 2023?

A2: The IBEX 35 experienced a remarkable 23% gain in 2023, marking its most positive annual performance since 2009.

Q3: What records were set in Spain’s bond sale in January 2024?

A3: Spain received a record €130 billion in bids for a bond sale, surpassing expectations and signaling confidence in the market.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4