You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

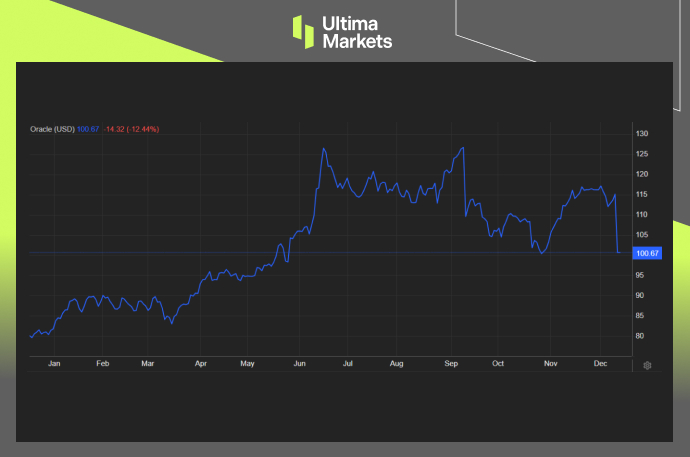

Oracle Stock: Unveiling 2Q Results and Future Projections

Oracle Corporation (ORCL.US) recently reported its fiscal 2Q results, revealing both triumphs and setbacks. The company’s revenue of $12.94 billion, a 5% YoY increase, fell short of the expected $13.05 billion. However, earnings per share outperformed expectations at $1.34 (adjusted), compared to the predicted $1.32.

Segment Breakdown

Delving into specific business segments, cloud services, and license support revenue rose by 12% to $9.64 billion, albeit slightly below the expected $9.71 billion.

Cloud and on-premises license revenue experienced an 18% decline to $1.18 billion, just under the anticipated $1.21 billion.

Services revenue also missed expectations at $1.37 billion versus the consensus of $1.40 billion.

Positive Highlights

On a positive note, cloud infrastructure revenue witnessed a significant 52% surge, reaching $1.6 billion. Oracle secured notable clients during this period, including Elon Musk’s AI startup xAI, Halliburton, and Samsung. However, Oracle faced challenges as xAI sought more AI chips than Oracle could provide due to industry-wide GPU shortages.

Strategic Moves

In a strategic move, Oracle announced Microsoft as a new cloud customer, planning to roll out 20 Azure-connected data centers over the next few months, according to co-founder Larry Ellison. Despite the setbacks, Ellison remains optimistic about Oracle’s future, projecting the Oracle Cloud Infrastructure’s growth rate to exceed 50% annually for the next few years.

Future Guidance

The 3Q guidance provided by Oracle fell short of analyst predictions. The company forecasted adjusted net income per share between $1.35-$1.39 and 6-8% revenue growth. Analysts had anticipated $1.37 adjusted EPS and $13.34 billion in revenue, reflecting a 7.6% revenue increase.

(Oracle Stock Performance One-year Chart)

Acquisitions and Market Performance

Despite the post-earnings share decline, Oracle stock has still achieved an impressive 41% gain in 2023, outperforming the S&P 500’s 20% return. Oracle’s NetSuite division also made a strategic move, acquiring the Australian field service software company Next Technik.

Frequently Asked Questions

Q: What is Oracle’s 3Q guidance?

A: Oracle’s 3Q guidance includes adjusted net income per share between $1.35-$1.39 and 6-8% revenue growth.

Q: How did Oracle’s cloud infrastructure revenue perform in 2Q?

A: Oracle’s cloud infrastructure revenue experienced a substantial 52% surge, reaching $1.6 billion.

Q: Which companies did Oracle secure as clients during the quarter?

A: Oracle secured major clients, including Elon Musk’s AI startup xAI, Halliburton, and Samsung.

Bottom Line

Despite challenges in certain segments, Oracle remains optimistic about its future growth. Strategic acquisitions, new partnerships, and a robust cloud infrastructure contribute to Oracle’s resilience in the dynamic tech landscape.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4