You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Federal Reserve Interest Rate Stability

The Federal Reserve (FED) held rates still at 5.25 to 5.5%. Chairman Powell said at a press conference after the meeting, “We will continue to make interest rate decisions on a case-by-case basis based on all data and the impact on economic activity and the outlook for inflation. ”

Chairman Powell’s Insights

Powell said that there is still great uncertainty about the timing of interest rate cuts. The forecast for 2024 is only a current estimate.

He believes that the time for interest rate cuts in 2024 will always come, but he said that he would not specify a specific time. He believes that the labor market will eventually weaken, but must proceed with caution, believing that the failure to restore price stability is a more serious problem.

Interest Rate Projections

Judging from the interest projections released with the statement, the FED is expected to raise interest rates by another 25 basis points this year, with interest rates peaking at 5.50%-5.75 %.

Technology stocks will be under increasing pressure as rising interest rates push up bond yields, attracting investors to shift more cash into the bond market.

(FOMC interest rate target level, FOMC)

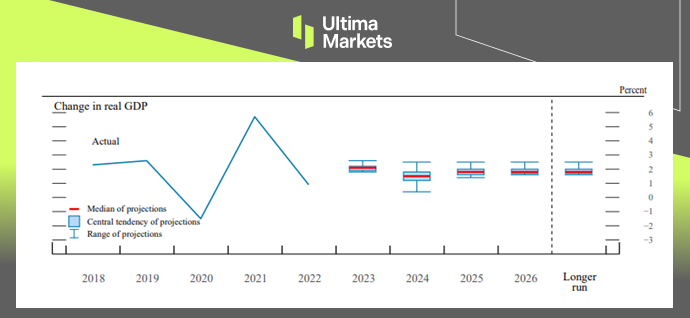

Revised GDP Forecasts

The FED believes that the U.S. economy is improving and has revised its 2023 gross domestic product (GDP) growth forecast upward to 2.1% from the 1.0% forecast in June. It has also revised the GDP forecast from 1.1% to 1.5% for 2024. The forecast value for 2026 was first announced at 1.8%.

(GDP Forecast, FOMC)

Conclusion

In conclusion, the Federal Reserve’s decision to maintain interest rates and revise GDP forecasts upwards in October 2023 is a clear indication of its faith in the U.S. economic outlook.

The FED’s cautious approach to interest rates, its commitment to data-driven decision-making, and its unwavering focus on price stability will play pivotal roles in steering the nation toward sustainable economic growth and stability in the years to come.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4