You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

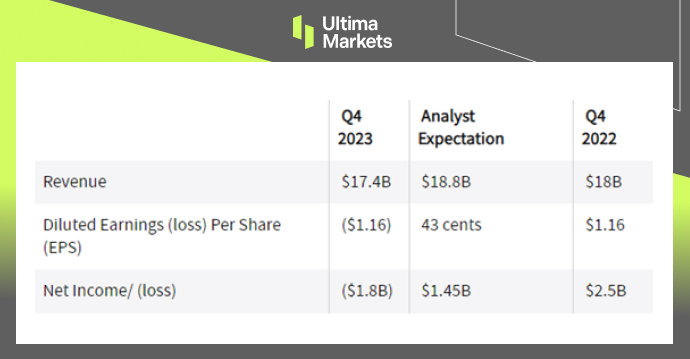

Citigroup’s Q4 2023 Financial Report: Unveiling Key Metrics and Challenges

Citigroup (C.US) recently released its fourth-quarter 2023 financial results, revealing a significant shift from the previous year’s positive outcome. The bank reported a substantial net loss of $1.8 billion, a stark contrast to the $2.51 billion net income recorded in the same period of 2022.

(Citigroup Earnings in Q4Y23)

Factors Contributing to the Loss

Surge in Credit Charges

The primary driver behind Citigroup’s Q4 loss was a notable surge in credit charges. The total cost of credit skyrocketed by 92%, reaching $3.547 billion. This increase significantly impacted the overall financial health of the bank, reflecting challenges in managing credit-related risks.

Decline in Total Revenues

Citigroup experienced a 3% decline in total revenues during the fourth quarter of 2023 on an annualized basis. This downturn in revenue further compounded the challenges posed by the surge in credit charges, creating a more complex financial landscape.

Operating Costs and Restructuring Efforts

Escalation in Operating Costs

The financial statement released on January 12 highlighted a 23% increase in total operating costs, amounting to $16 billion in Q4 2023. Within these expenses, $1.7 billion was attributed to pre-tax and divestiture-related costs, indicating ongoing restructuring efforts within the organization.

CEO’s Perspective on Restructuring

CEO Susan Fraser emphasized the bank’s commitment to simplification and divestitures, mentioning ongoing efforts to streamline operations by divesting several retail banking businesses globally. Despite the current challenges, Fraser expressed confidence in reaching medium-term targets and returning capital to shareholders after completing the Transformation.

“Given how far we are down the path of our simplification and divestitures, 2024 will be a turning point as we’ll be able to completely focus on the performance of our five businesses and our Transformation,” Fraser commented.

Citi CEO Jane further said, “We remain confident in our ability to adapt to evolving capital and macro environments to reach our medium-term targets and return capital to our shareholders, whilst continuing the investments needed for our Transformation.”

Key Metrics and Future Outlook

Focus on Key Metrics

Citigroup reported key metrics such as a net loss of $1.8 billion and a net loss per share of $1.16 on $17.4 billion of revenue. Excluding notable items, diluted EPS would have been $0.84, with a Return on Tangible Common Equity (RoTCE) of 4.1% for the quarter.

These metrics provide valuable insights into the bank’s financial performance during a challenging quarter.

Future Outlook and Medium-Term Targets

Despite the Q4 setbacks, Citigroup remains optimistic about the future. CEO Fraser sees 2024 as a turning point, allowing the bank to focus entirely on its five core businesses and Transformation efforts.

The bank aims to adapt to evolving capital and macro environments, achieve medium-term targets, and continue investments needed for sustained growth.

Frequently Asked Questions

Q: What contributed to Citigroup’s Q4 2023 net loss?

A: The significant net loss in Q4 2023 was primarily driven by a surge in credit charges and a 3% decline in total revenues.

Q: What are the key metrics reported by Citigroup for Q4 2023?

A: Citigroup reported a net loss of $1.8 billion, a net loss per share of $1.16, and key metrics such as diluted EPS of $0.84 and RoTCE of 4.1% for the quarter.

Q: How is Citigroup addressing its challenges and restructuring efforts?

A: CEO Susan Fraser highlighted ongoing efforts to simplify and divest, with 2024 expected to mark a turning point for Citigroup to focus on core businesses and complete its Transformation.

For More Detailed Information, You Can Refer To:

- Citigroup Q4 2023 Earnings Call Transcript

- Fourth Quarter and Full Year 2023 Results and Key Metrics

- Citigroup Swings To A $1.8B Loss In Q4 As Charges Mount

- Fourth Quarter and Full Year 2022 Results and Key Metrics

- Citi Q4 Loss Hits $1.8B on Credit Charge Surge

- Citigroup posts $1.8 billion fourth-quarter loss after litany…

- Citigroup’s Q4 Earnings Beat Estimates, Revenues…

- Citigroup Stock (NYSE:C): Looking Past the Losses.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4