You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Ark Invest Bold Strategies in the Crypto Market

As the cryptocurrency markets experience a revival, major players like Coinbase are hitting record highs. In this dynamic landscape, ARK Invest, a prominent asset manager, has made noteworthy decisions that diverge from the market trend.

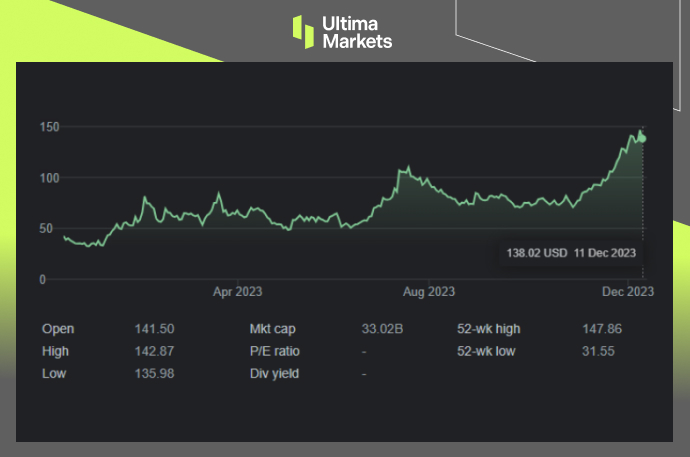

Coinbase’s Soaring Stock Amid Crypto Resurgence

Coinbase (COIN.US), the leading U.S. cryptocurrency exchange, has witnessed a surge in its stock price, reaching yearly highs. This upswing is attributed to a resurgent crypto market and the legal challenges faced by its rival, Binance, in the United States.

However, despite Coinbase’s meteoric rise, ARK Invest has chosen to capitalize on the opportunity. On December 5th, ARK sold 237,572 shares of Coinbase stock, securing a substantial profit of at least $33 million. Notably, this isn’t the first instance of ARK actively trading Coinbase stock in 2023, demonstrating a strategic approach to navigate the market fluctuations.

(Coinbase: COIN.US, One-year Chart)

ARK’s Ongoing Confidence in Coinbase

Even with the recent sale, ARK Invest maintains a significant stake in Coinbase. The exchange still represents the top asset for three different ARK funds, constituting over 11% of net assets in each.

Additionally, ARK serves as the custodian or surveillance partner for issuers of Bitcoin and Ethereum spot ETFs awaiting regulatory approval, showcasing enduring confidence in Coinbase.

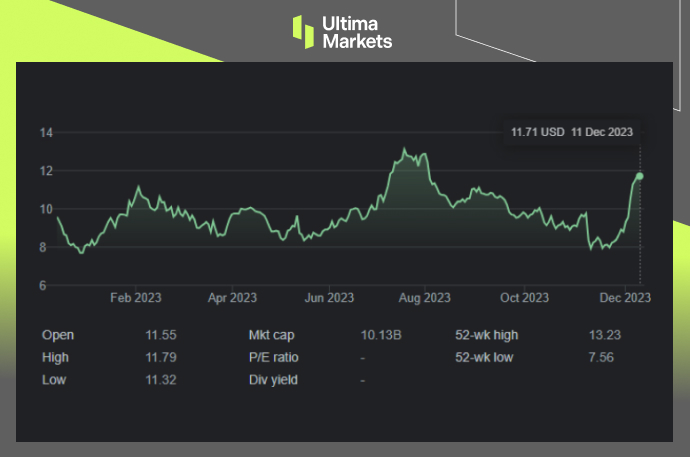

Diversification Beyond Coinbase

ARK Invest’s strategic moves extend beyond Coinbase. The firm has been acquiring shares of Robinhood (HOOD.US), a trading platform with crypto capabilities, and SoFi Technologies (SOFI.US), a fintech firm that recently terminated its crypto trading services. These actions underscore ARK’s commitment to diversifying its exposure across the still-volatile digital asset sector.

(Robinhood: HOOD.US, One-year Chart)

Frequently Asked Questions

Q: What prompted ARK Invest to sell Coinbase shares amid its rising stock price?

A: ARK Invest actively manages its portfolio based on market dynamics, taking advantage of profit opportunities when they arise.

Q: How does Coinbase feature in ARK’s overall investment strategy?

A: Despite recent sales, Coinbase remains a significant asset in multiple ARK funds, indicating a sustained strategic position in the exchange.

Q: Why is ARK investing in other platforms like Robinhood and SoFi?

A: ARK Invest aims to diversify its crypto exposure and hedge against volatility by expanding its holdings beyond a single platform.

Conclusion

In navigating the evolving crypto landscape, ARK Invest’s strategic decisions reflect a dynamic approach to capitalize on market opportunities and mitigate risks. The firm’s confidence in Coinbase and diversified investments underscore a nuanced strategy in the face of crypto market fluctuations.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4