Positive Signs Arise from The World’s Economic ‘Canary in The Coal Mine’ – South Korea

South Korea’s exports play a pivotal role as a leading economic indicator, often referred to as the world’s “canary in the coal mine”. This is due to the country’s substantial exposure to the three largest economies: the United States, China, and Japan.

Growth in December 2023

In a positive turn of events, South Korea’s exports showed resilience, experiencing a 5.1% year-over-year growth in December 2023, reaching $57.6 billion. While slightly below the anticipated 6.6% increase, this marked the third consecutive month of export expansion.

Driving Forces

The growth was primarily fueled by a remarkable rebound in semiconductor exports, surging by 21.8%. This sector demonstrated sustained momentum, posting a second consecutive monthly increase. Notably, automobile exports continued their impressive 18-month growth streak with a 17.9% jump, while display products and home appliances increased by 10.9% and 2.9%, respectively.

Global Dynamics

Examining the destination of these exports, shipments to the United States experienced robust growth, rising by 20.8%. However, the same cannot be said for exports to South Korea’s top trading partner, China, which continued their decline, dropping by 2.9%.

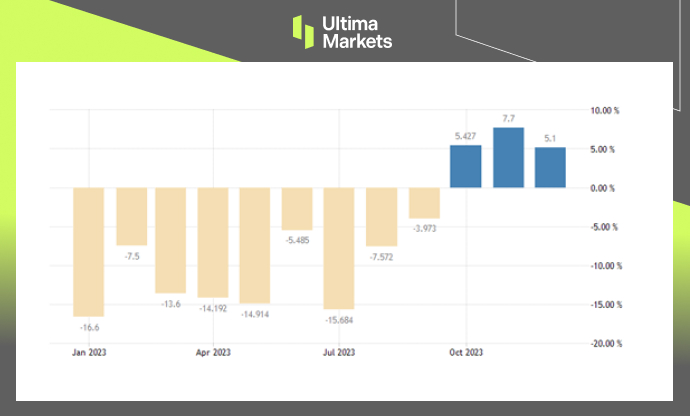

(Exports YoY, MOTIE Korea)

Annual Overview

Despite the positive developments in December, South Korea’s overall exports for the full year of 2023 experienced a 7.4% decline compared to 2022. This significant downturn was primarily attributed to a substantial 23.7% plunge in chip sales, driven by global economic uncertainty and China’s economic softening.

Challenges Persist

While December showcased better-than-expected growth, challenging external conditions persisted for Korean exporters. The global economic landscape remains dynamic and poses ongoing challenges despite the recent positive indicators.

Frequently Asked Questions

Q: What are the key drivers of South Korea’s export growth?

A: The recent growth is powered by a rebound in semiconductor exports, with a notable surge of 21.8% in December.

Q: How did exports to the United States and China perform?

A: Shipments to the United States witnessed robust 20.8% growth, while exports to China continued their decline, dropping by 2.9%.

Q: Why did South Korea’s overall exports decline for the full year of 2023?

A: The significant downturn is primarily attributed to a 23.7% plunge in chip sales amid global economic uncertainty and China’s softening economy.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2023 Ultima Markets Ltd. All rights reserved.

ทําไมต้องซื้อขายโลหะมีค่าและสินค้าโภคภัณฑ์กับ Ultima Markets?

Ultima Markets ให้บริการด้วยต้นทุนที่เหมาะสมแข่งขันได้ในสภาพแวดล้อมการซื้อขายที่ดีที่สุดสำหรับสินค้าที่เป็นที่นิยมแพร่หลายทั่วโลก

เริ่มการซื้อขายตรวจสอบความเป็นไปของตลาด

ตลาดมีความอ่อนไหวต่อการเปลี่ยนแปลงของอุปสงค์และอุปทาน

ดึงดูดนักลงทุนที่สนใจเฉพาะการเก็งกําไรราคา

สภาพคล่องที่สูงและหลากหลายโดยไม่มีค่าธรรมเนียมแอบแฝง

ไม่มี dealing desk และไม่มี requotes

การดําเนินการที่รวดเร็วผ่านเซิร์ฟเวอร์ Equinix NY4