JPMorgan’s Financial Overview: A Deep Dive into Quarterly Profits and Annual Records

JPMorgan Chase (JPM.US), the United States’ largest bank, recently released its fourth-quarter financial report, providing insights into its performance and setting the stage for a detailed analysis of its yearly achievements.

JPMorgan Quarterly Earnings and Net Income

In the fourth quarter of 2023, JPMorgan reported earnings per share of $3.04, accompanied by a revenue of $38.6 billion. Despite the decline in quarterly profits to $9.3 billion, a 15% decrease from the previous year’s $11 billion, the bank’s overall financial health remains robust.

JPMorgan Annual Profit and Growth

JPMorgan’s CEO, Jamie Dimon, emphasized the bank’s remarkable full-year performance, with annual earnings reaching a record $49.6 billion. The acquisition of First Republic contributed significantly, generating $4.1 billion in profit and solidifying JPMorgan’s position as a financial powerhouse.

Impact of FDIC Special Assessment

JPMorgan disclosed a unique challenge in the form of a special assessment from the FDIC, resulting in a $2.9 billion cost and a reduction of 74 cents in earnings per share. The bank clarified that excluding this adjustment, earnings would have been $3.97 per share.

Market Performance and Future Outlook

The bank’s growth, reminiscent of its post-2008 crisis expansion, positions JPMorgan as a key player in the industry. Its strategic move in acquiring First Republic strengthens its foothold amid challenges faced by regional banks.

JPMorgan Chase continues to navigate the financial landscape, exceeding expectations in areas such as net interest income and credit quality, as highlighted by CEO Jamie Dimon.

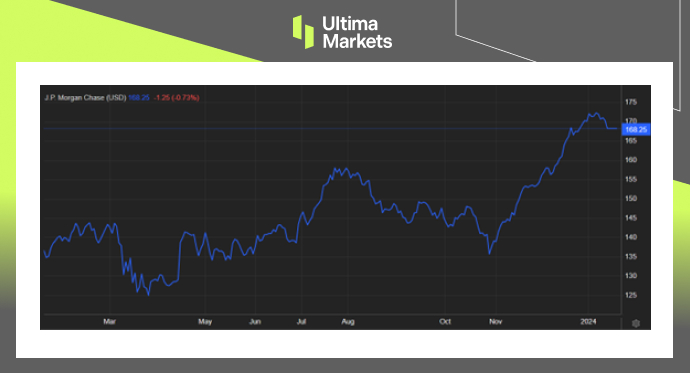

(JPMorgan Chase Stock Performance Yearly Chart)

Frequently Asked Questions

Q: Where can I find JPMorgan’s official quarterly earnings report?

A: You can access JPMorgan’s official quarterly earnings report directly from their investor relations page.

Q: What contributed to JPMorgan’s decline in quarterly profits?

A: The decline in quarterly profits is attributed to a special assessment from the FDIC, resulting in a $2.9 billion cost.

Q: How did JPMorgan perform in terms of yearly net income?

A: JPMorgan achieved a remarkable yearly net income of $49.6 billion, setting a new record.

Bottom Line

JPMorgan Chase’s financial journey in 2023 reflects both challenges and triumphs. As it navigates the complex financial landscape, the bank’s strategic decisions and robust performance showcase its resilience and strategic prowess.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2023 Ultima Markets Ltd. All rights reserved.

ทําไมต้องซื้อขายโลหะมีค่าและสินค้าโภคภัณฑ์กับ Ultima Markets?

Ultima Markets ให้บริการด้วยต้นทุนที่เหมาะสมแข่งขันได้ในสภาพแวดล้อมการซื้อขายที่ดีที่สุดสำหรับสินค้าที่เป็นที่นิยมแพร่หลายทั่วโลก

เริ่มการซื้อขายตรวจสอบความเป็นไปของตลาด

ตลาดมีความอ่อนไหวต่อการเปลี่ยนแปลงของอุปสงค์และอุปทาน

ดึงดูดนักลงทุนที่สนใจเฉพาะการเก็งกําไรราคา

สภาพคล่องที่สูงและหลากหลายโดยไม่มีค่าธรรมเนียมแอบแฝง

ไม่มี dealing desk และไม่มี requotes

การดําเนินการที่รวดเร็วผ่านเซิร์ฟเวอร์ Equinix NY4