UK Inflation Falls Below 2%, Sparks Speculation of Rate Cut

TOPICSTags: Bank Of England, Inflation, Rate Cut, UK, Unemployment Rate

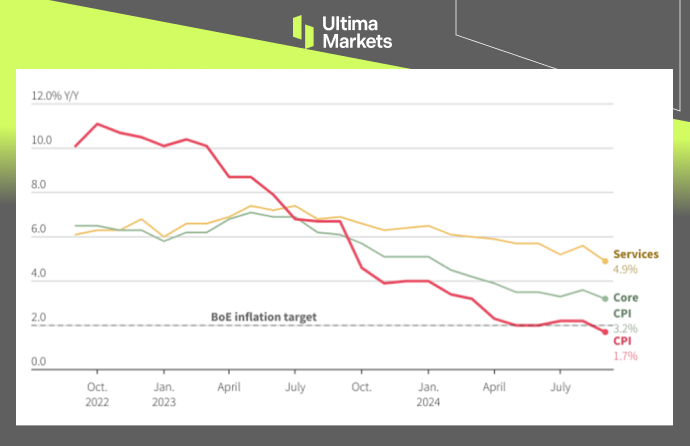

The United Kingdom’s annual consumer price inflation eased to 1.7% in September, down from 2.2% in August, marking the lowest reading since April 2021. This decline, attributed to lower airfares and petrol prices, was reported by the Office for National Statistics. The figure came in below economists’ expectations of 1.9%.

(UK Inflation Data, Source: Office for National Statistics)

In addition, private sector pay growth slowed to 4.8% in the three months leading up to August, aligning with the Bank of England’s forecast of a 4.8% increase for the third quarter. Further indicating a cooling labor market, the number of estimated vacancies in the UK dropped by 34,000 to 841,000 in the three months ending in September, a level comparable to pre-pandemic conditions. The unemployment rate also fell to 4.0% during the three months to August, the lowest level this year, accompanied by a record surge in employment.

As a result, this series of economic data has heightened expectations of a rate cut by the Bank of England. Interest rate futures now suggest a 90% likelihood of two quarter-point rate cuts by the BoE before year-end, up from an 80% chance earlier in the week. This inflation report removes a key obstacle for the Monetary Policy Committee to vote for a 25bps rate cut at its November meeting.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server