You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

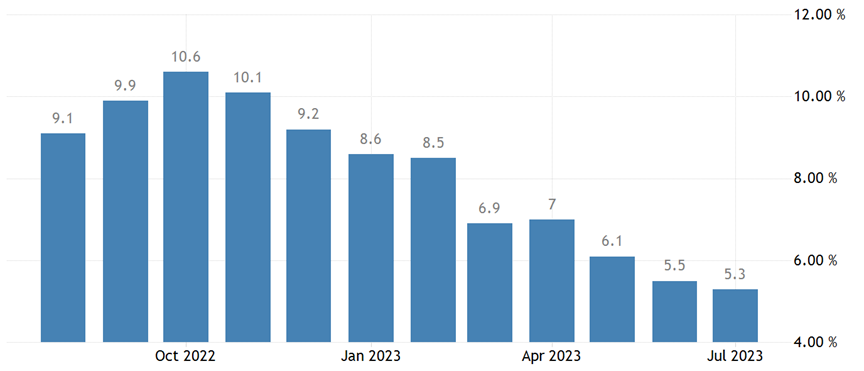

At last, the euro has shrugged off bad economic news and inflation has come under control. It might be the time for ECB to reconsider its tightening monetary policy . Investors will focus on whether the European Central Bank will pause interest rate hikes in September as expected.

(Inflation rates in the euro zone in the past year)

The August PMI report due on Wed. is going to be in the spotlight. Forecasts show the manufacturing sector slumps further, and start to take a toll on services sector, endangering the euro zone economy.

With sluggish numbers, the ECB could take a break in September rate hike, however, the euro might receive a hit. Most economists believe the ECB will pause rate hikes in September but see room for an increase before the end of 2023 amid rising inflation.

Separately, at the Jackson Hole Global Central Bank Economic Symposium on Saturday, European Central Bank President Lagarde’s speech is going to be very important. Investors will look for clues from the review.

Based on data released in the past week, the US economy continued to maintain a strong momentum. Retail sales and manufacturing figures unexpectedly rose as residential numbers climbed. The strength of the U.S. dollar has caused the euro to remain in a downward trend.

(EUR/USD daily cycle, Ultima Markets MT4)

July 4th represents a turning point at present. If it is broken, the upward momentum will subside, leaving little hope for EUR/USD to stage a rebound.

It is worth noting that the overall volatility of the euro against the US dollar has slowed down significantly. Both the overall volatility on the chart and the average level of the 200 -period ATR indicators are declining. As a result, Lagarde’s speech is going to shift the market volatility.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Mengapa Berdagang Logam & Komoditi dengan Ultima Markets?

Ultima Markets menyediakan persekitaran kos dan pertukaran yang paling kompetitif untuk komoditi lazim di seluruh dunia.

Mohon sekarangMemantau pasaran secara terus

Pasaran terdedah kepada perubahan dalam penawaran dan permintaan

Menarik kepada pelabur yang hanya berminat dalam spekulasi harga

Kecairan mendalam dan pelbagai tanpa yuran tersembunyi

Tiada dealing desk dan tiada sebut harga semula

Pelaksanaan pantas melalui pelayan Equinix NY4