U p c o m i n g

- All

- Dividend

- Product Updates

- CFD Rollover

- Trading Hours

- Maintenance

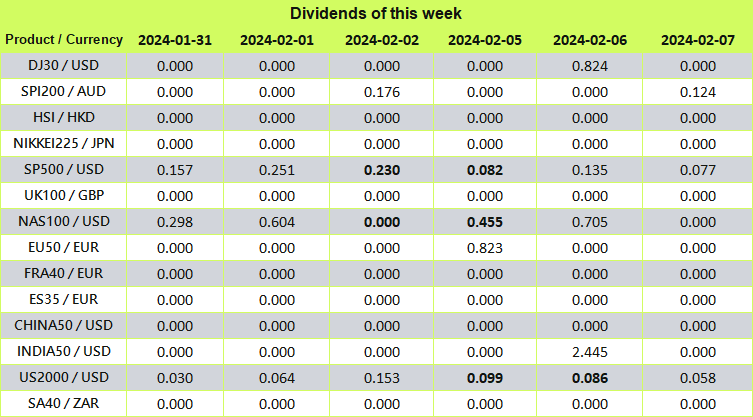

1 February 2024

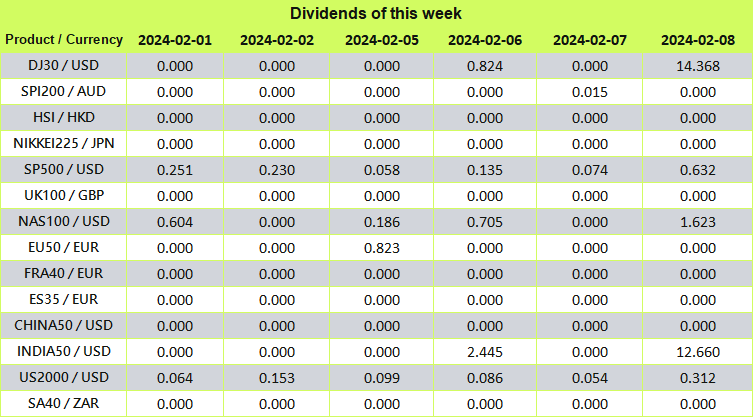

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

1 February 2024

Ultima Markets The trading sessions of holiday in Feb

| Holiday | Date | Adjustments (Product / Actions) | |

| LUNAR NEW YEAR | 2024.02.09 | 10:30 Early Close | HK50, HK50ft |

| LUNAR NEW YEAR | 2024.02.12 | Market Closed | HK50, HK50ft, BVSPX |

| LUNAR NEW YEAR | 2024.02.13 | Market Closed | HK50, HK50ft, BVSPX |

| LUNAR NEW YEAR | 2024.02.14 | 18:00 Late Open | BVSPX |

| 21:55 Early Close | |||

| USA Presidents Day | 2024.02.19 | Market Closed | Cotton, OJ, Cocoa, Coffee, Sugar, Soybean,Wheat |

| US shares | |||

| 18:30 Early Close | VIX | ||

| 20:00 Early Close | DJ30, DJ30ft, SP500, SP500ft, NAS100, NAS100ft, US2000, Nikkei225, JPN225ft, TY |

||

| 21:30 Early Close | GOLD, SILVER, COPPER, XPDUSD,XPTUSD | ||

| USOUSD, CL-OIL, NG, GAS | |||

| 23:00 Early Close | UK100, UK100ft, GER40, GER40ft, EU50 | ||

Friendly Reminder

- • The mentioned times are based on DST system time GMT+2.

- • Liquidity providers might adjust the trading sessions base on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

31 January 2024

Ultima Markets – The Rollover Schedule of Futures in Feb

The Rollover Schedule of Futures in Feb

|

Symbol |

Description |

Rollover Date |

Current Contract |

Next Contract |

|---|---|---|---|---|

VIX |

Volatility |

2024/2/8 |

Feb-24 |

Mar-24 |

CL-OIL |

Crude Oil West Texas Future |

2024/2/15 |

Mar-24 |

Apr-24 |

FRA40ft |

France 40 Index Future |

2024/2/15 |

Feb-24 |

Mar-24 |

FLG |

UK Long Gilt Futures |

2024/2/21 |

Mar-24 |

Jun-24 |

CHINA50ft |

CHINA50 Future |

2024/2/22 |

Feb-24 |

Mar-24 |

UKOUSDft |

Brent Oil Future |

2024/2/23 |

Apr-24 |

May-24 |

HK50ft |

Hong Kong 50 Future |

2024/2/27 |

Feb-24 |

Mar-24 |

TY |

US 10 YR T-Note Futures Decimalised |

2024/2/27 |

Mar-24 |

Jun-24 |

FGBX |

Euro – BUXL Futures |

2024/3/1 |

Mar-24 |

Jun-24 |

FGBS |

Euro – Schatz Futures |

2024/3/1 |

Mar-24 |

Jun-24 |

• Internal transfers will be suspended during the half-hour before and after the rollover.

• Investors are advised to carefully manage their positions or adjust the take-profit and stop-loss settings before the rollover.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com.

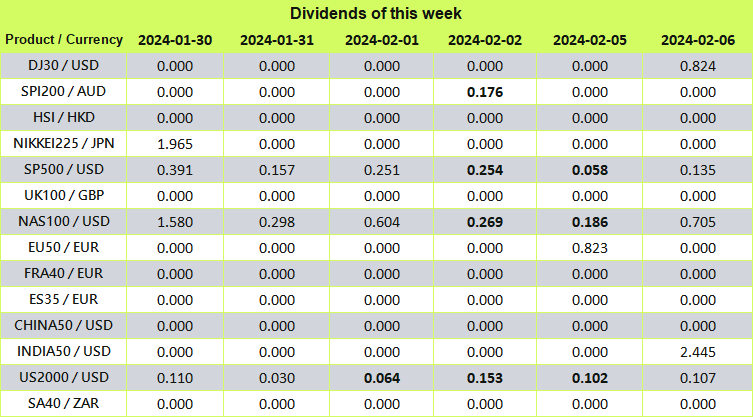

31 January 2024

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

30 January 2024

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

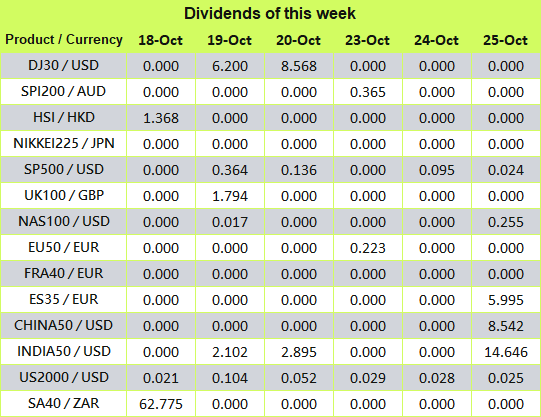

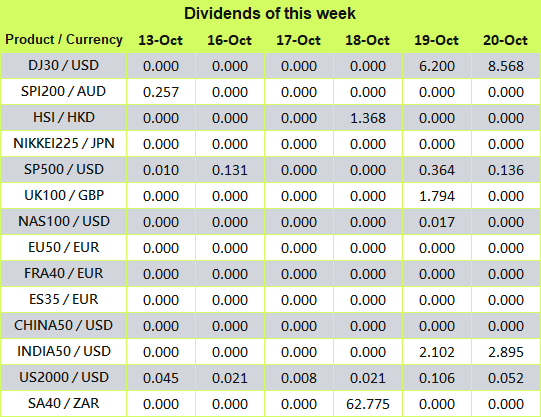

18 October 2023

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

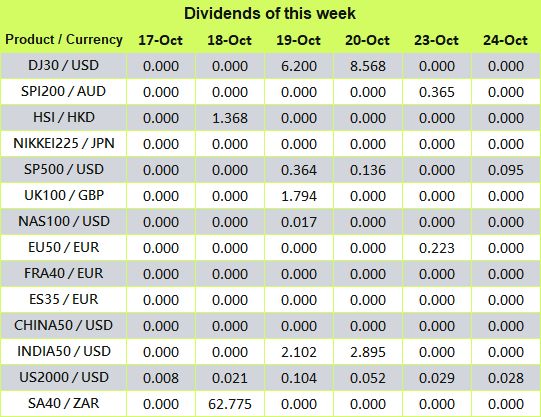

17 October 2023

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

16 October 2023

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

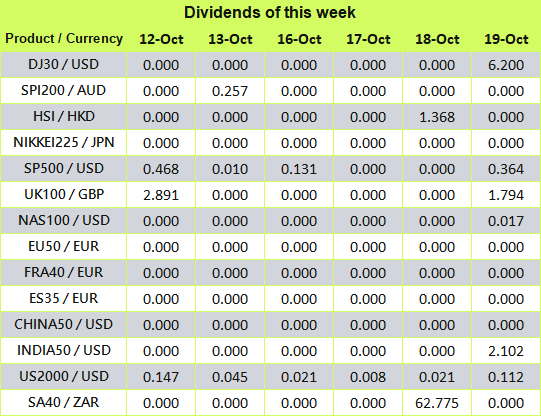

13 October 2023

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

12 October 2023

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com