Weaker Inflation Might Trigger Rate Cut from the SNB

TOPICSTags: CPI, Inflation, Rate Cut, SNB, Swiss franc

Inflation Falls Short of Expectations

On Tuesday, data from the Federal Statistics Office revealed that Swiss annual inflation edged up to 0.7% in November from 0.6% in October, falling short of the forecasted 0.8%. Meanwhile, consumer prices dipped by 0.1% compared to the previous month, aligning with expectations.

(Switzerland CPI y/y, Source: Investing.com)

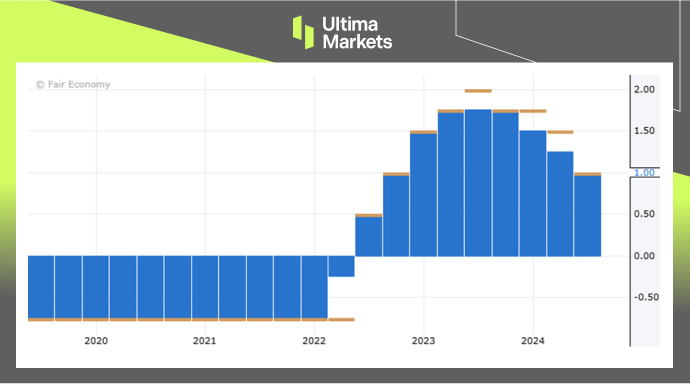

In 2024, the Swiss National Bank (SNB), which aims to maintain inflation between 0% and 2%, has implemented three 25-basis-point rate cuts, bringing its benchmark rate to the current level of 1%. Market expectations now suggest a 71% probability of a 50-basis-point cut and a 29% likelihood of a 25-basis-point reduction at the SNB’s upcoming monetary policy meeting on December 12. Earlier market sentiment had favoured a smaller 25-basis-point cut.

(Swiss National Bank’s Policy Rate, Source: Forex Factory)

Looking ahead, two additional 25-basis-point rate cuts are anticipated in March and June 2025, potentially lowering the benchmark rate to 0%. Beyond this, the possibility of reintroducing negative interest rates cannot be ruled out, as the SNB has indicated it remains open to such measures.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server