US Manufacturing PMI Shows Improvement, but Stagnant Inflation Remains a Concern

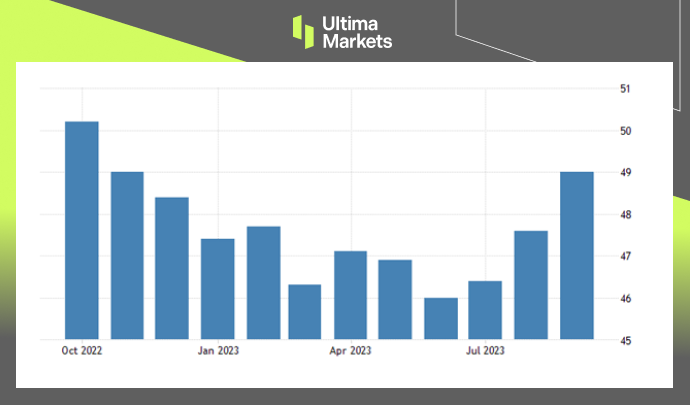

The ISM manufacturing purchasing managers’ index rose to 49 in September from 47.6 last month, well above market expectations of 47.8, reflecting the slowest contraction in the U.S. manufacturing industry in ten months.

Even as the economic slowdown improved, data still showed U.S. factory activity contracting on a month-on-month basis for nearly a year in a row, underscoring the impact of rising borrowing costs from the Federal Reserve on the industry.

Trends in New Orders and Production

Although new orders fell for the 13th consecutive month, the pace of decline slowed significantly as the changing supply chain environment pushed customers to take on more engineering (process).

Production rebounded from August’s stagnation and set the largest increase since July 2022.

(ISM Manufacturing PMI, Institute for Supply Management)

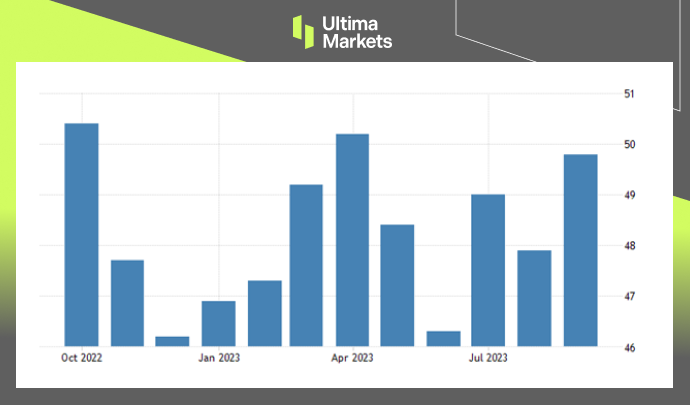

S&P Global US Manufacturing PMI

The S&P Global US Manufacturing PMI was revised higher to 49.8 in September 2023, surpassing the preliminary estimate of 48.9 and exceeding August’s final reading of 47.9.

The latest figure pointed to a fifth consecutive month of contraction in the sector’s health, albeit only fractional. Output increased at a marginal pace that was nonetheless the fastest since May.

In contrast, job creation remained moderate, and new orders continued to decline for the fifth consecutive month, reflecting the impact of high interest rates and inflation on consumer demand.

Inflation and Business Confidence

On the price front, both input costs and output charges accelerated, though inflation rates remained historically low, well below the levels seen over the past three years.

Moreover, business confidence reached its highest level since April 2022, driven by optimism about an impending improvement in demand conditions.

Stagnant Inflation (Stagflation)

(US Manufacturing PMI, S&P Global)

Based on the surveys, although survey data have improved overall, manufacturing reports show that production continues to slow down, and prices are accelerating again. The phenomenon presented is “stagnant inflation (Stagflation)“.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server