US Job Growth Misses Forecasts, Dollar Slides to 4-Months Low

TOPICSTags: DXY, economic data, NFP, Non-Farm Payroll, Unemployment Rate

US Job Growth Misses Forecasts, Dollar Slides to 4-Months Low

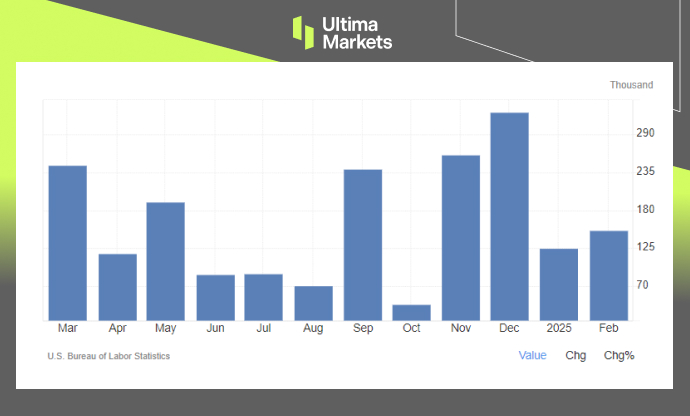

In February 2025, the U.S. economy added 151,000 jobs, falling short of the expected 170,000 but improving from January’s revised 125,000. However, the unemployment rate edged up to 4.1% from 4.0%, signaling slight labor market softening.

(US Non-Farm Payrolls, Source: Trading Economics)

Non-Farm Sector Highlights: Government Employment Declines

Federal government employment fell by 10,000 jobs, reflecting the early impact of President Trump’s Department of Government Efficiency (DOGE) initiative aimed at reducing federal hiring.

In contrast, the private sector remained mixed—”Healthcare and Social Assistance” saw strong growth with 70,000 new jobs, while “Transportation Services” added 45,000 positions. However, Retail and F&B services struggled, each shedding 35,000 jobs, possibly due to immigration policy shifts.

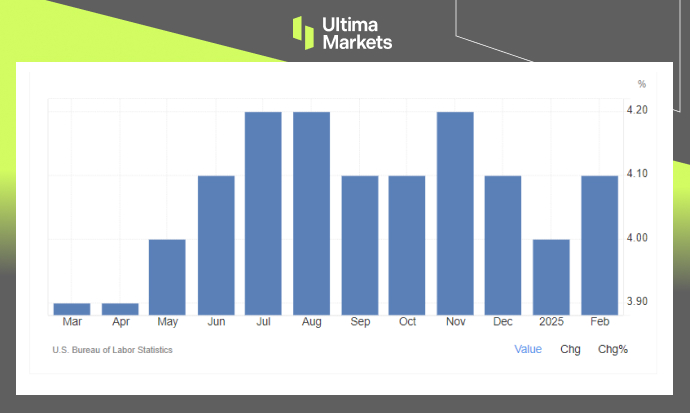

Unemployment Rate Rises Slightly

The unemployment rate increased to 4.1%, mainly due to a rise in job separations, suggesting more individuals either lost or voluntarily left their jobs. Additionally, fewer unemployed individuals successfully re-entered the workforce.

(US Unemployment Rate, Source: Trading Economics)

Despite these changes, the unemployment rate has remained within a narrow range of 4.0% to 4.2% since May 2024, suggesting relative stability in the labor market. However, the slight weakening in labor market conditions, combined with ongoing Trump-related policy uncertainty, remains a key concern for investors.

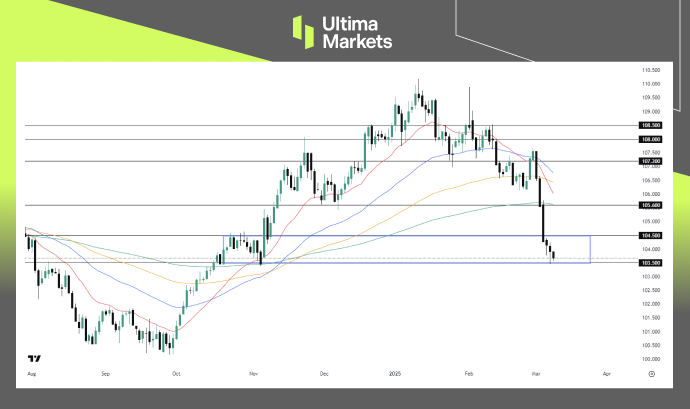

Outlook for US Dollar Index

The U.S. Dollar Index (DXY) extended its losses on Friday following the release of the latest Non-Farm Payrolls and labor market data, reinforcing concerns about U.S. economic weakness and weighing further on the dollar.

(Dollar Index, Day Chart Analysis; Source: TradingView)

From a technical perspective, DXY remains in a bearish trend, though it is now approaching a major support level near 103.50. This could lead to a near-term rebound or a period of consolidation as markets shift focus to this week’s U.S. Consumer Price Index (CPI) report.

Additionally, investors are likely to hold off on major moves until further clarity emerges from the Federal Reserve’s March rate decision next week.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server