Unemployment Falls to 4%, Fed Eyes Inflation Outlook

TOPICSTags: FED, Hourly Earnings, Labor Market, NFP, Unemployment

U.S. Job Growth Slows, Inflation Risks Persist

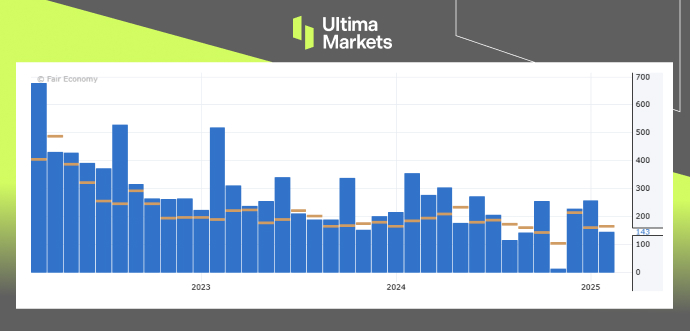

New data from the U.S. Bureau of Labor Statistics, released on Friday, revealed that average hourly earnings have remained above 4% year-over-year since last fall, a level exceeding the Federal Reserve’s comfort zone for maintaining its 2% inflation target. Additionally, a survey showed a sharp increase in consumer inflation expectations for the year ahead, rising to 4.3% in February from 3.3% in January. Moreover, the latest data revealed that companies added 143,000 jobs in January, falling slightly short of the 170,000 forecasted. However, upward revisions to previous figures further strengthened the already robust job gains recorded at the end of 2024.

(U.S Non-Farm Employment Change, Source: Forex Factory)

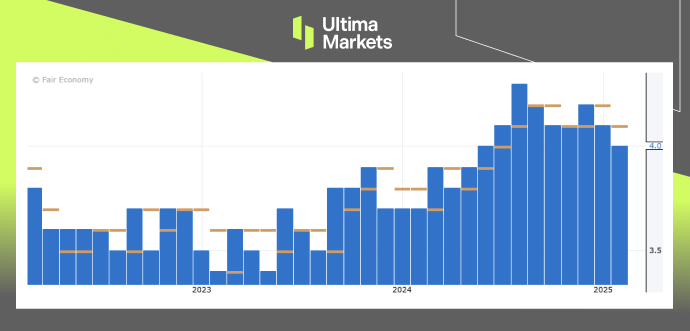

Despite concerns about labor market weakness last year, when the unemployment rate edged higher, the job market has since rebounded, with unemployment falling to 4% last month. Speaking at an auto symposium in Detroit on Thursday, Chicago Fed President Austan Goolsbee reflected on the shift, noting that the central question had been whether the economy would stabilize at full employment or face a sharp rise in joblessness, as historically seen when unemployment trends upward.

Instead, the labor market appears to have settled at full employment, Goolsbee suggested, emphasizing that while conditions could still overheat or deteriorate, the current balance is ideal from a policy standpoint. Although unemployment remains slightly higher than the 3.4% low of 2023, it is still below the 4.2% threshold the Fed associates with stable inflation, reinforcing the view that the central bank has avoided a recession while creating enough slack to curb inflationary pressures.

(U.S Unemployment Rate, Source: Forex Factory)

However, the risk now lies in whether inflation will continue its downward trajectory. Revised data indicate that wage growth has remained at or above 4% year-over-year, a persistent challenge for the Fed. Meanwhile, the recent uptick in inflation expectations highlights policymakers’ concerns about maintaining public confidence in their ability to bring inflation under control.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server