U.S. Stock on Historic Surge After Trump U-Turn on Tariffs

TOPICSU.S. stock markets experienced a dramatic rally on April 9, 2025, after President Donald Trump announced a temporary 90-day suspension of tariffs on imports from various countries. The unexpected policy shift sparked investor optimism, resulting in significant gains across major U.S. stock indices and global markets. Notable surges in key U.S. indices include:

- Dow Jones Industrial Average (DJIA): The DJIA surged by 2,962.86 points (7.9%).

- S&P 500: The S&P 500 jumped 9.5%.

- Nasdaq Composite: The Nasdaq rose 12.2% (1,857.06 points)

This rally marked one of the most substantial single-day gains in recent history, highlighting the market’s positive response to the tariff pause.

Pause on Tariff-But China Tariff Increase

The announcement came as a surprise to markets, which had been bracing for the continuation of a trade war. The U.S. president’s decision to pause tariffs on imports from most countries was seen as a potential step toward de-escalating global trade tensions.

However, tariffs on Chinese imports were still increased to 125%, continuing the ongoing trade standoff between the U.S. and China. In response, China retaliated by imposing an 84% tariff on U.S. goods.

The rally in U.S. stocks was mirrored by positive movements in global markets. In Asia, Japan’s Nikkei 225 surged 8.3%, while Australia’s ASX 200 rose by 4.7%. European markets also saw gains, as investors viewed the tariff pause as a positive signal for international trade relations.

Cautious Optimism on Escalation Trade Tension

Despite the positive market performance, investors should remain cautious about the long-term impact of ongoing trade disputes. The pause in tariffs is seen as a temporary measure, and with the escalation of tariffs on China, uncertainties continue to loom over the global economy.

Ultima Market Analysts have urged investors to remain vigilant, noting that the trade policy shift could be just the beginning of a broader realignment of U.S. trade relations.

While the market’s reaction to the tariff suspension is positive, further developments in U.S.-China trade tension are likely to have a significant impact on the direction of the financial markets in the coming weeks.

US Benchmark Index in Bearish Territory

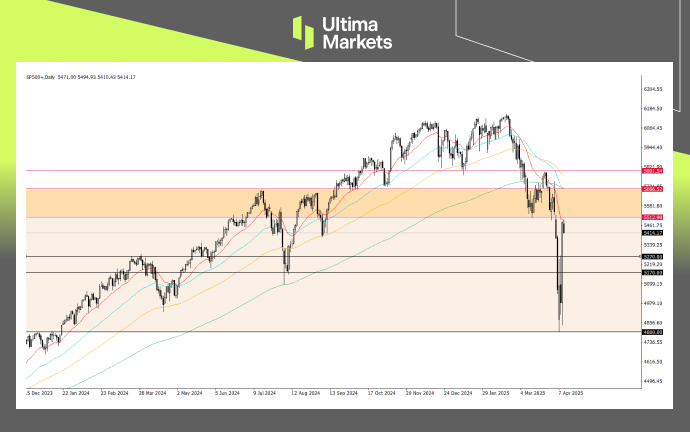

(S&P500 Index–SP500+, Daily Chart; Source: Ultima Market MT5)

Despite the S&P500‘s notable 9.5% gain, the index remains below bearish territory for now. For investors, this rally serves as a reminder of the volatility linked to global trade dynamics, emphasizing the importance of closely monitoring political and economic developments.

Looking ahead, volatility could resurface on Friday with the release of the latest U.S. Consumer Price Index. If inflation data comes in higher than expected, it could temper investor sentiment, raising concerns about how tariffs may impact U.S. inflation.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server