U.S. Inflation Jumps, Fed Holds Firm on Rates

TOPICSTags: CPI, FED, Rates Cut, Tariff, U.S Inflation

Inflation Heats Up, Tariffs Add to Uncertainty

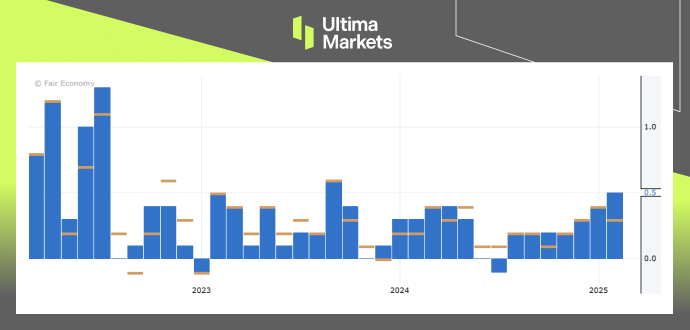

U.S. consumer prices saw their sharpest increase in nearly 1.5 years in January, reinforcing the Federal Reserve’s cautious approach to interest rate cuts amid economic uncertainty. The consumer price index (CPI) rose 0.5% last month, the biggest gain since August 2023, following a 0.4% increase in December, according to the Bureau of Labor Statistics.

(U.S CPI m/m Chart, Source: Forex Factory)

(U.S CPI y/y Chart, Source: Forex Factory)

Shelter costs, including hotels and motels, climbed 0.4%, accounting for nearly 30% of the CPI increase. Food prices rose 0.4%, with grocery costs surging 0.5%, driven by a 15.2% spike in egg prices, marking the largest jump since June 2015. Higher inflation was partly attributed to businesses raising prices at the start of the year, evident in record prescription medication costs and increased motor vehicle insurance rates.

Meanwhile, the Trump administration’s economic agenda faces challenges from persistent inflation. While Trump campaigned on lowering costs, high inflation could complicate plans for tax cuts and large-scale deportations, which might lead to labor shortages and rising wages. Additionally, his proposed tariffs including a hike to 25% on steel and aluminum, could slow growth while also fueling inflation, further complicating the Fed’s decision-making.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server