U.S. Retail Sales Thrived in September 2023

As we delve into the latest economic data for September 2023, it becomes evident that the U.S. retail and manufacturing sectors are experiencing notable developments.

This comprehensive report highlights the key statistics and trends that are shaping these critical segments of the American economy.

Consumer Spending Takes the Lead

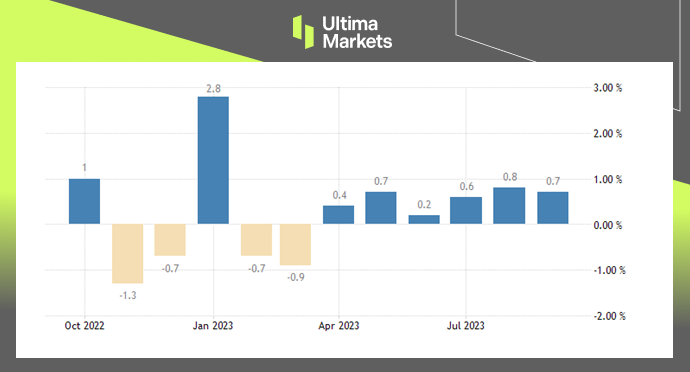

In September, U.S. retail sales increased by a solid 0.7%, building on the previous month’s 0.8% rise. This is good news, especially given the challenges posed by high prices and borrowing costs. Consumers continued to show confidence by spending more than expected, defying economic uncertainties.

Leading Categories

Several categories saw remarkable growth:

- Miscellaneous store retailers: Up by 3%

- Non-store retailers: A solid increase of 1.1%

- Motor vehicles and parts dealers: An impressive 1% growth

- Gasoline stations: 0.9% increase

It’s important to note that these figures don’t account for inflation, making these results even more noteworthy.

(Retail Sales, United States Department of Commerce)

Diverse Sectors Register Growth

In addition to the standout categories, other sectors also did well:

- Food services and drinking places: 0.9% rise

- Health and personal care stores: An 0.8% increase

- Food and beverage stores: 0.4% growth

- General merchandise stores: Also up by 0.4%

However, some sectors experienced declines:

- Electronics and appliances: Decreased by 0.8%

- Clothing stores: A drop of 0.8%

- Building material and garden equipment stores: A slight dip of 0.2%

Even when we exclude automobile sales, gasoline, building materials, and food services, retail sales still rose by a solid 0.6%. These results are a testament to consumer resilience in the face of economic challenges.

Strong U.S. Manufacturing Output Growth

Manufacturing Shines

In September, production in U.S. factories increased more than expected, even though there were strikes in the automobile industry that limited the production of motor vehicles. This is additional proof that the economy finished the third quarter with strength.

Positive Manufacturing Data

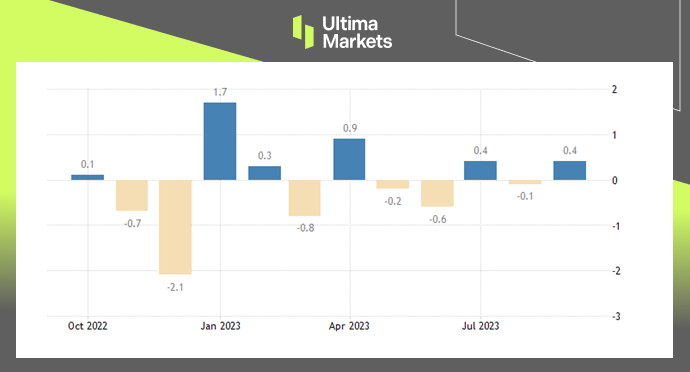

The Federal Reserve reported a 0.4% increase in manufacturing output last month. In contrast, the data for August was revised downwards, showing a 0.1% decrease in factory production, instead of the previously reported 0.1% increase. Economists surveyed by Reuters had predicted a 0.1% uptick in factory output.

Year-on-Year Analysis

Looking at the year-on-year basis, production saw a 0.8% decline in September, with no change in the third quarter. Durable goods manufacturing output increased at an annualized rate of 2.3%, but this was offset by a 2.4% decline in nondurable manufacturing.

(Manufacturing Production MoM, FED)

Summary

In summary, the data for September 2023 highlights a resilient U.S. retail sector and a manufacturing industry that’s bouncing back from challenges. Consumers are spending with confidence despite rising prices, and manufacturers are adapting positively.

Staying informed and agile in these sectors is essential for businesses and investors looking to seize the opportunities presented by these trends.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server