The Resilient Rise of Wegovy and Ozempic

The Danish pharmaceutical company, Novo Nordisk (NVO), has recently updated its financial outlook for the year due to the increasing demand for its weight loss drug, Wegovy, and diabetes medication, Ozempic.

These drugs are administered through weekly injections and have been sought after by patients for their significant weight loss effects.

These two medical innovations have taken the pharmaceutical world by storm, delivering remarkable results for patients who have long sought effective solutions for their health concerns.

Novo Nordisk Market Triumph

Novo Nordisk’s financial outlook for the year has seen a remarkable revision, reflecting the surging popularity of Wegovy and Ozempic.

As demand for these life-changing drugs continues to grow, the company is now anticipating a substantial boost in sales.

Novo Nordisk’s revised forecast suggests a growth in sales between 32% to 38%, up from the previous estimate of 27% to 33%.

The company also anticipates an operating profit growth of 40% to 46%, an increase from the earlier prediction of 31% to 37%.

It’s evident that Novo Nordisk’s optimistic outlook is fueled by the unanticipated success of Ozempic, particularly in the U.S. market.

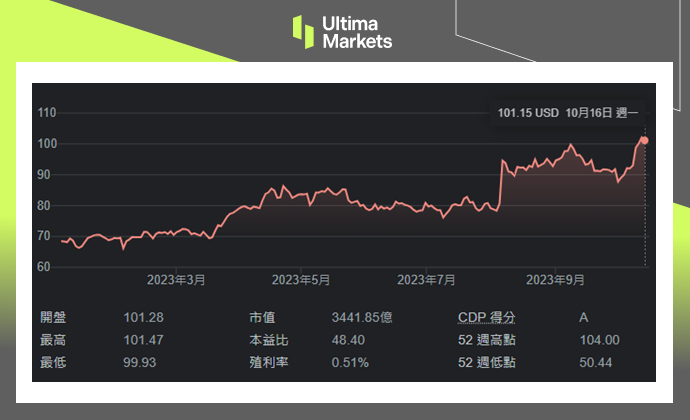

Novo Nordisk’s Stock Hit YTD High

The popularity of Wegovy and Ozempic has propelled Novo Nordisk to become Europe’s most valuable company. The company’s U.S.-listed shares (ADR) also saw a new high for the year.

This exceptional market performance is a testament to the company’s unwavering commitment to improving the health and well-being of individuals around the world.

The market is keenly awaiting Novo Nordisk’s third-quarter earnings report, scheduled for release on November 2nd, which is expected to underscore the company’s impressive growth trajectory.

Strategic US$1.3B Acquisition: Ocedurenone

In a strategic move to further expand its portfolio and contribute to improved healthcare, Novo Nordisk has made a substantial acquisition.

Novo Nordisk has decided to buy the new drug called Ocedurenone for $1.3 billion from KBP Biosciences. The drug can help people with high blood pressure that is hard to control.

This acquisition, set to be finalized by the end of 2023, is anticipated to be a game-changer in the field of cardiovascular health. Importantly, it’s worth noting that this acquisition is not expected to affect Novo Nordisk’s overall profit for the year, ensuring that the company’s financial stability remains intact.

(Novo Nordisk ADR YTD Chart)

Novo Nordisk’s continuous commitment to pioneering medical breakthroughs, coupled with its exceptional market performance, solidifies its position as a key player in the pharmaceutical industry.

The company’s unwavering dedication to improving patients’ lives is reflected in their outstanding financial results and their strategic acquisitions, setting the stage for a promising future in healthcare.

Novo Nordisk Transformative Impact

In conclusion, Novo Nordisk’s success story is a testament to the transformative impact of Wegovy and Ozempic.

Their upwardly revised financial forecast, soaring stock performance, and strategic acquisitions are all indicators of a company that’s dedicated to making a meaningful difference in the lives of people worldwide.

As Novo Nordisk continues to innovate and meet the ever-growing healthcare needs of the population, its future prospects appear exceedingly bright.

For the latest news and updates, delve deeper into our articles.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server