Mann Signals Caution Despite Bold Rate Cut Move

TOPICSTags: BoE, Mann, Rate Cut, UK Economy, UK Inflation

BoE’s Mann Clarifies Surprise Rate Cut Vote

Bank of England policymaker Catherine Mann clarified on Tuesday that her unexpected vote last week for a 50 basis-point rate cut should not be interpreted as support for a series of reductions or an indication that she would take the same stance in March. While her decision surprised investors, it aligned with her generally proactive approach, in contrast to the more measured, step-by-step strategy preferred by most members of the BoE’s Monetary Policy Committee.

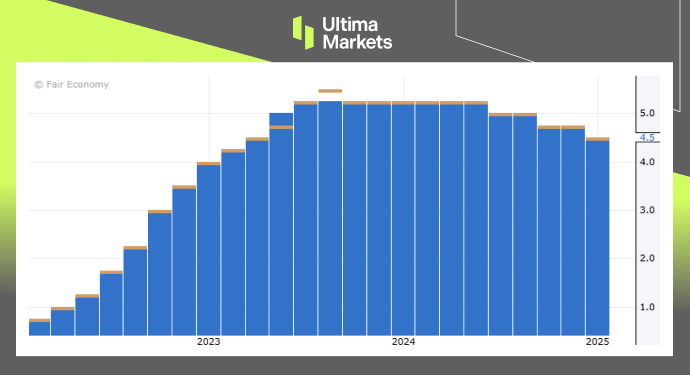

(Bank of England’s Bank Rate, Source: Forex Factory)

Speaking on Tuesday, Mann reaffirmed her belief in maintaining restrictive monetary policy and estimated that the long-term neutral interest rate for the UK would likely be at the upper end of the 3.0-3.5% range identified in a BoE investor survey. Her outlook differs from that of Swati Dhingra, another Monetary Policy Committee member who also supported a 50 basis-point cut who has consistently advocated for looser monetary policy.

Mann explained that, until now, she had favored keeping rates unchanged due to structural weaknesses in the UK economy that contribute to inflationary pressures. She pushed back against the idea that her vote signaled support for back-to-back cuts, stating: “Those structural impediments continue to be in evidence in this economy, and so the notion that somehow I support ’50 now, 50 next time’, that would not be a full reading of what I have just said.”

However, she ultimately shifted her stance after seeing enough signs of weakening consumer demand, a potential sharp downturn in the labor market, and declining corporate pricing power, leading her to drop her opposition to cutting rates.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server