Japan’s Core Inflation Cools Unexpectedly, U.S. Acknowledges Japan and South Korea’s Currency Woes

TOPICSTags: Bank of Japan, Japan, Won, Yen

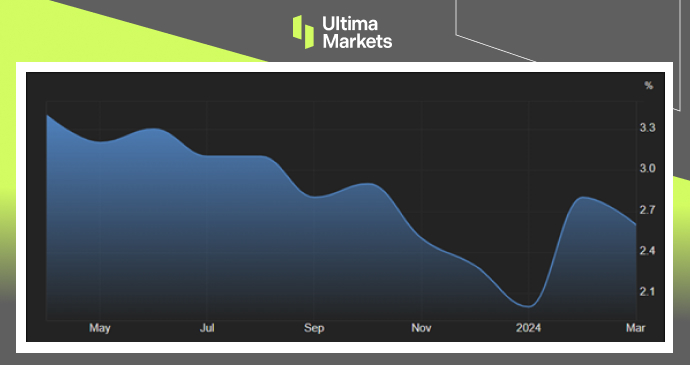

Japan’s core consumer price index, which excludes fresh food but includes fuel costs, rose 2.6% year-over-year in March 2024, decelerating from a four-month high of 2.8% in February. Despite the slowdown, the core inflation rate remained above the Bank of Japan’s (BOJ) 2% target for the 24th consecutive month. The deceleration was attributed to mild rises in food prices, while the sustained high inflation was driven by the yen’s weakness and elevated commodity prices.

In response to rising wages and persistent high inflation, the BOJ shifted its monetary policy stance in March, raising interest rates for the first time since 2007. The move marked the end of eight years of negative interest rates. However, the central bank is expected to maintain an accommodative stance for some time. BOJ board member Asahi Noguchi stated that the pace of future policy adjustments is anticipated to be gradual and cannot be compared to the recent tightening cycle undertaken by other major central banks.

While the core inflation figure of 2.6% in March came in below the forecasted 2.7%, it highlighted the ongoing inflationary pressures in Japan’s economy, prompting the BOJ’s policy normalization efforts.

(Core Inflation Rate,Statistics Bureau of Japan)

During their inaugural trilateral meeting on Wednesday, senior finance officials from the United States, Japan, and South Korea voiced mutual concerns regarding the recent depreciation of the Japanese yen and the South Korean won. They pledged to maintain close communication and coordination to address volatility in the currency markets.

While the Japanese yen found some stability, trading near the 154 level against the U.S. dollar, it remained perilously close to the 34-year low reached earlier in the week. This persistent weakness in the yen’s value can be attributed to the divergent monetary policy stances adopted by the Bank of Japan and the U.S. Federal Reserve.

(USDJPY Yearly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server