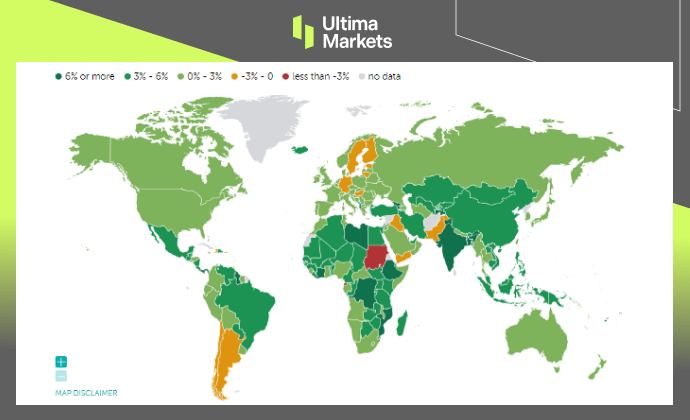

World economy to grow 3% YoY

The International Monetary Fund (IMF) expects the world economy to grow by 3% this year as stronger-than-expected growth in the United States offsets lower prospects for China and Europe and cut its 2024 growth forecast by 0.1 percentage point to 2.9%.

Fast economic recovery in the US

The International Monetary Fund says: “The strongest recovery among major economies is the United States, which is increasingly consistent with a ‘soft landing’ scenario.” The agency expects the overall economic growth of the 20 countries using the euro to be 0.7% for 2023 and 1.2% next year; while China’s economy will grow by 5% this year and 4.2% in 2024, and specifically points out: “The crisis in China’s real estate industry may deepen and have global spillover effects, especially for commodity exporters.” In contrast, the U.S. economic growth forecast is raised to 2.1% in 2023 and 1.5% in 2024.

Global inflation forecast raises to 6.9%

The International Monetary Fund raises its global inflation forecasts for this year and next year by 0.1 and 0.6 percentage points to 6.9% and 5.8% respectively. Commodity prices pose “serious risks” to the inflation outlook and could become more volatile due to climate and geopolitical shocks. “Expectations of higher inflation in the future are likely to influence current inflation rates, keeping them high,” the IMF notes.

Real estate impacted by high interests

The International Monetary Fund also addresses that the prospect of “higher in the longer term” interest rates has led to sharp falls in house prices in some countries. Vulnerabilities in the commercial real estate sector “pose significant risks to the financial sector” and urge policymakers to assess the impact that a sharp drop in real estate prices could have on financial institutions.

(GDP YoY Growth 2023,IMF)

(GDP YoY Growth,IMF )

Red: developing economies,Yellow: World,Green: Advanced economies

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server