On Wednesday, March 27, the Hang Seng Index suffered a drop of 225.48 points, or 1.36%, closing at 16,392.84. The decline spanned across all sectors, coming on the heels of significant gains in the previous session. Market nervousness was heightened by China’s stocks reaching a near one-month low, coupled with the largest daily exodus of foreign capital since mid-January. Despite a jump in industrial profits in China for January and February, investor sentiment remained tempered as they await the upcoming weekend release of China’s PMI data with caution.

(Hang Seng Index Monthly Chart)

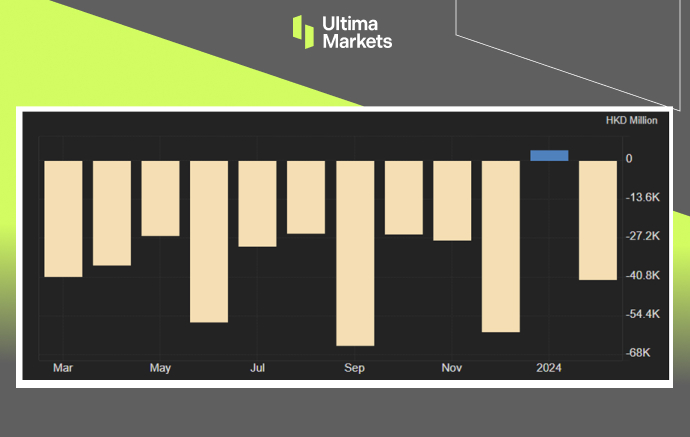

In February 2024, Hong Kong’s trade deficit contracted a bit to $41.7 billion compared to its previous year’s counterpart of $45.4 billion. On a yearly basis, exports dipped by 0.8% to a total of $284.1 billion. The downtrend was influenced significantly by reduced trade in various sectors, including non-ferrous metals (a downturn of 38.1%), non-metallic mineral manufacturers (dipping by 16.6%), and photographic and optical equipment along with watches and clocks (down by 15.6%).

On the contrary, some sectors experienced an uplift in trade, such as telecommunications and sound recording equipment (upgrowth of 10.1%), as well as office machines and automatic data processing equipment (progression of 6.6%). Meanwhile, imports decreased 1.8% from the previous year, reaching $325.7 billion. The decrease was chiefly due to lesser acquisitions of non-ferrous metals (down 38.4%), professional, scientific, and controlling instruments (down 24.7%), and power-generating machinery and equipment (down 24.1%).

When evaluating the cumulative trade deficit from January to February 2024, a noticeable reduction is evident as the deficit plunged from $70.7 billion during the same period in 2023, to $38 billion.

(Hong Kong Balance of Trade,Census and Statistics Department)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server