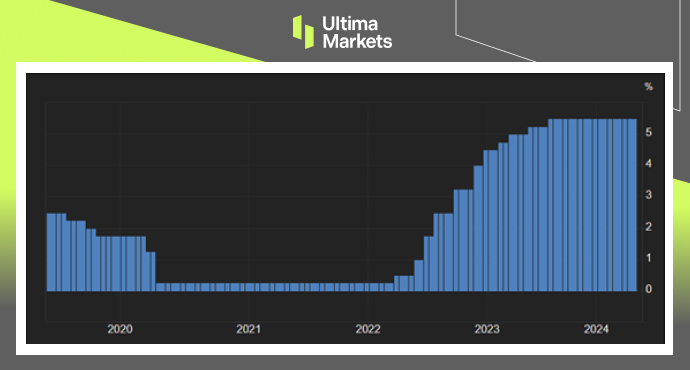

The Federal Reserve maintained the target range for the federal funds rate at 5.25%-5.50% during its May meeting for the sixth consecutive time. The decision was driven by ongoing inflationary pressures and a tight labor market, indicating a lack of progress in bringing inflation back down to the 2% target this year.

However, Chair Powell stated that he does not foresee a rate hike as likely and believes that the current policy is sufficiently restrictive to achieve the 2% inflation target. Additionally, the Fed has declared its intention to reduce the pace of its quantitative tightening starting from June 1st. This adjustment will involve cutting the maximum amount of Treasury securities being removed from the balance sheet by over 50%, down to $25 billion monthly from the previous $60 billion.

(Historical Fed Funds Rates)

Private employers in the United States have surpassed expectations by adding 192,000 jobs to their workforce in April 2024, according to ADP. This growth exceeds the anticipated 175,000 jobs and comes after an increase of 208,000 jobs in the previous month. The hiring saw widespread participation across different sectors.

In other economic news, the S&P Global US Manufacturing PMI dropped to 50 in April from 51.9 in March, coming in under the predicted level of 52. Although it was a slight improvement from the preliminary forecast of 49.9, the index indicated a halt in manufacturing growth for the first time this year, after three consecutive months of strong expansion. Manufacturers curtailed their purchasing in response to a decline in new orders, as clients exercised more caution and were hesitant to place new orders.

Despite the setback, production continued to rise due to the completion of existing backlogged work. Demand for production capacity remained largely the same, while staffing numbers saw a slight decrease and purchasing volumes a slight increase.

In terms of expenses, input costs saw a sharp rise driven by the increasing prices of oil and metals. Despite current challenges, the manufacturing sector maintains a general sense of optimism regarding future output levels over the next year.

(Dollar Index Weekly Chart)

Following the Federal Reserve’s decision to slow down the pace of quantitative tightening, the yield on the US 10-year Treasury note decreased, settling below 4.64% from its more than five-month peak of 4.7% reached on April 25th. Similarly, the dollar index dipped below the 106 level.

On Wednesday, the stock market in the US showed mixed results. The S&P 500 and Nasdaq both relinquished earlier gains, each dropping by 0.34%, while the Dow Jones Industrial Average went up, gaining 87 points (+0.23%). In the corporate arena, both CVS (CVS.US) and Starbucks (SBUX.US) saw significant declines, dropping 16.84% and 15.88% respectively, after reporting disappointing results. The semiconductor industry also saw a downturn, with Nvidia (NVDA.US) losing 3.89%, influenced by AMD’s (AMD.US) 8.91% fall following a dreary forecast for AI chip sales, and Super Micro Computer (SMCI.US) dropping 14.03% after the Q3 revenue did not meet expectations.

(S&P500 Index Six-month Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server