Balancing Inflation and Employment

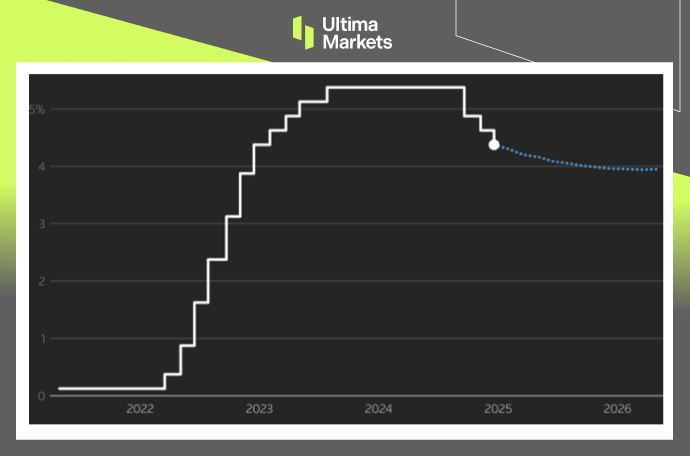

On Sunday, Federal Reserve Governor Adriana Kugler and San Francisco Fed President Mary Daly underscored the complex balancing act facing U.S. central bankers as they aim to slow the pace of rate cuts this year. Last year, the Fed reduced short-term interest rates by a full percentage point, bringing them to their current range of 4.25%-4.50%.

(Market Expectation for U.S Federal Funds Rate Chart, Source: LSEG)

“We are fully aware that we are not there yet—no one is celebrating just yet,” Kugler stated during the annual American Economic Association conference in San Francisco. In November, the unemployment rate stood at 4.2%, a level both she and Daly consider consistent with the Fed’s dual mandate of maximum employment and price stability. Daly added, “At this point, I wouldn’t want to see any further weakening in the labour market, perhaps some natural month-to-month fluctuations, but certainly no additional slowdown.” She shared these remarks while participating in the same panel discussion.

Inflation, measured by the Fed’s preferred gauge, has dropped significantly from its mid-2022 peak of around 7%, reaching 2.4% in November. However, it remains above the Fed’s 2% target. In December, policymakers revised their outlook, anticipating slower progress toward achieving this goal than previously expected.

Adding to this picture of a resilient economy, new unemployment claims fell to an eight-month low last week, signalling minimal layoffs at the close of 2024 and reflecting continued labour market strength. Notable decreases in unadjusted claims were observed in California and Texas, while significant increases were recorded in Michigan, New Jersey, Pennsylvania, Ohio, Massachusetts, and Connecticut.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server