Economic Activity Surges, Diminishing Likelihood of Fed Rate Reduction

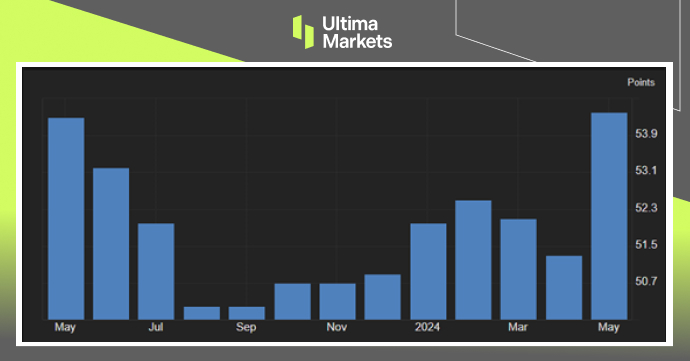

TOPICSThe S&P Global US Composite PMI jumped to 54.4 in May, a significant increase from 51.3 in April, achieving its highest point since April 2022 and surpassing the anticipated figure of 51.1 based on initial data.

The service sector played a pivotal role in this rise, recording a PMI of 54.8 and demonstrating the largest output expansion in a year. Manufacturing also experienced robust growth, with a PMI of 50.9. Despite continued layoffs, the rate of job reduction decreased as companies displayed more optimism about the future and reported larger inflows of orders. The cost of inputs and the prices of outputs ascended more sharply, with manufacturing leading in price hikes in the past months. Yet, the inflation of selling prices remained beneath the annual average. Expectations for future output also saw an uplift from the lowest point in five months recorded in April.

(U.S. Composite PMI,S&P Global)

On Thursday, Wall Street experienced a downturn after an unexpectedly high PMI survey stoked fears of sustained higher interest rates. The Dow Jones tumbled by 605.78 points (-1.53%), marking its worst performance of the year. In a similar vein, both the S&P 500 and the Nasdaq Composite fell from their all-time highs, dropping by 0.74% and 0.39%, respectively.

The preliminary S&P Global PMIs exceeded forecasts, showing a quickening in US business activities. This development, along with continuous inflation, fueled beliefs that the Federal Reserve might keep its interest rate policy unchanged, resulting in an increase in Treasury yields.

Most mega-cap stocks declined, with the exception of Nvidia (NVDA.US) which soared by 9.32%, reaching over $1,000 per share for the first time, thanks to its earnings and revenue surpassing expectations, propelled by a strong demand for AI chips. On the flip side, Boeing’s (BA.US) shares decreased by 7.55% following its CFO’s prediction of a negative free cash flow and no improvement in plane deliveries for the second quarter due to enduring production issues.

(S&P 500 Index Monthly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server