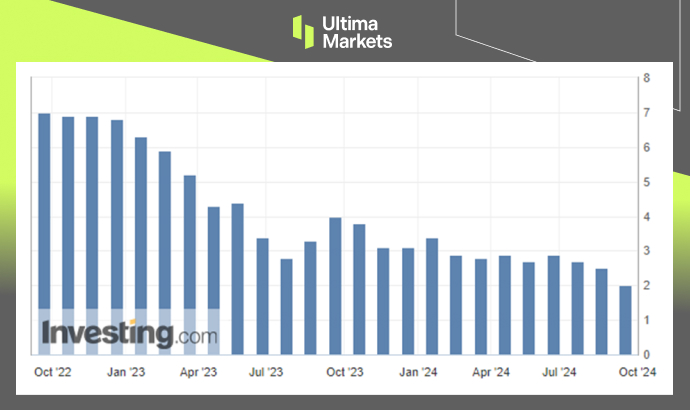

On Tuesday, the Canadian dollar edged lower against its U.S. counterpart as U.S inflation data led some investors to speculate that the Bank of Canada might align with a potential substantial interest rate cut by the Federal Reserve. Canada’s annual inflation rate slowed to 2% in August, down from 2.5% in July, aligning with the Bank of Canada’s inflation target and marking the slowest pace since February 2021. This result was below the expected 2.1%.

(Canada CPI YoY Chart, Source: Investing.com)

Earlier this month, at the Bank of Canada’s monetary policy announcement, Governor Tiff Macklem emphasized the need to guard against the risk of inflation falling below the target due to sluggish economic growth.

Canada’s economic growth has been slowing, with third-quarter GDP expected to come in at just half of the Bank of Canada’s projection. The steady increase in the unemployment rate and the deceleration in economic expansion indicate that elevated interest rates are effectively cooling the economy.

Moreover, it has lowered its key policy rate three times consecutively, reducing it by a total of 75 basis points to 4.25%. Market anticipate that central bankers will cut their policy rate by 50 basis points next month to accelerate the shift toward a more neutral stance. A neutral policy stance is when the interest rate is within the so-called neutral range of 2.25% to 3.25%, a level where rates neither constrain nor stimulate economic growth. Therefore, investors anticipate approximately 100 basis points of total easing across the final three BoC meetings in 2024, suggesting at least one cut exceeding 25 basis points.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server