A Balancing Act Between Inflation and Growth

The year 2024 has been quite a roller coaster for political and economic events. The final interest rate decision meeting is scheduled for this month by the Federal Reserve. The minutes of the November meeting give insight into their next steps. A key takeaway is that many officials expressed the possibility of gradually transitioning from a restrictive to a more neutral monetary policy stance, provided economic data meets expectations—specifically, inflation steadily declining toward the 2% target and the economy maintaining near-full employment. The appearance of the term “gradually” in the meeting minutes, a significant departure from prior language, indicates the Fed is indeed slowing the pace of rate cuts.

Among these, the deletion of a confident statement about inflation moving toward 2% in the press release is particularly remarkable. It indicates that Fed officials closely watch the threat of short-term inflation stagnation and could well consider the factor while deciding on the continuity of rate cuts. Market dynamics provide further hints: the US Dollar Index has sharply risen after a two-week consolidation following the September 18 FOMC meeting, at which the Fed initiated monetary easing amidst fears of an economic slowdown. This means that the market has toned down its expectations for the pace and extent of future rate changes.

(US Dollar Index Chart)

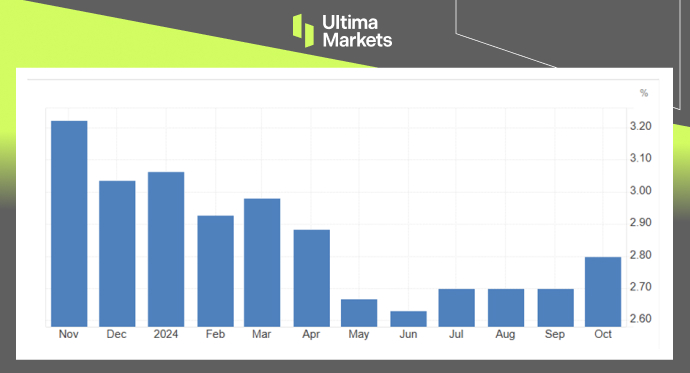

We look to a number of economic indicators for guidance on whether another rate cut is possible by year-end. The US Department of Commerce released the October PCE Index, the Fed’s preferred measure of inflation, on November 27. The annual increase of 2.3% met market expectations and was higher than September’s 2.1%. Core PCE grew 2.8% year-over-year, aligning with expectations but marking the largest annual increase since April.

Service price increases were the main driver, with core services prices, excluding housing and energy, increasing 0.4% from September, the largest monthly gain since March. Short-term inflation has been sticky, and further declines have been difficult to achieve. The annualized three-month growth rate of core PCE stands at 2.8%, still a considerable distance from the target of 2%.

(Core PCE YoY%, Bureau of Economic Analysis)

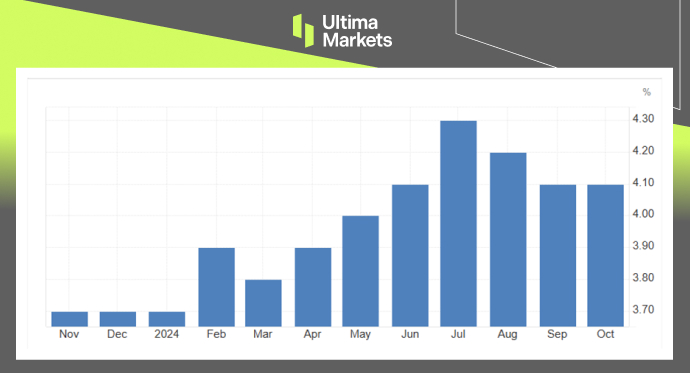

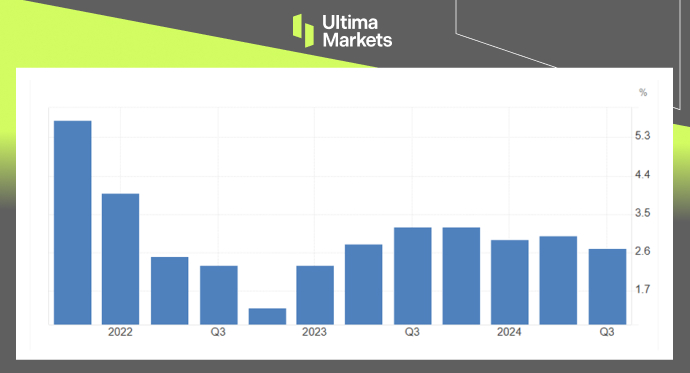

Meanwhile, the unemployment rate in October stood at 4.1% for the second consecutive month, a fact that reflects its resilience against hurricanes and corporate layoffs. In this vein, upcoming data is expected to look very good due to seasonal adjustments but show no signs of economic weakness. Other data also points to good economic health: personal spending was up 0.4% month-over-month in October, and Q3 GDP was up at an annualized rate of 2.7%, indicating strong household and business spending.

(Unemployment Rate, Bureau of Economic Analysis)

(GDP YoY%, Bureau of Economic Analysis)

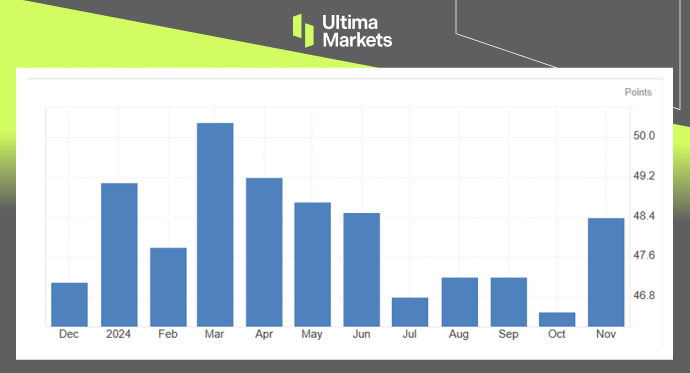

For this context, the US November ISM Manufacturing PMI came at 48.4 points, beating market expectations at 47.6 points. Thus far this year, only one result breached the 50-threshold, demarking contraction versus expansion, but closer reading again shows some encouraging trends, including a New Orders Index that leaped to 50.4 from 47.1 in the prior month—a five-month high. Even so, the sector clearly has not yet fully worked out its problems.

(ISM Manufacturing PMI)

In conclusion, the Fed is likely to adopt a wait-and-see approach in December, reserving flexibility for future actions and leaving rates unchanged. If a rate cut does occur, it will likely be limited to 25 basis points, with rates expected to hold steady during the first-quarter seasonal lull, potentially allowing inflation to cool further.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server