You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

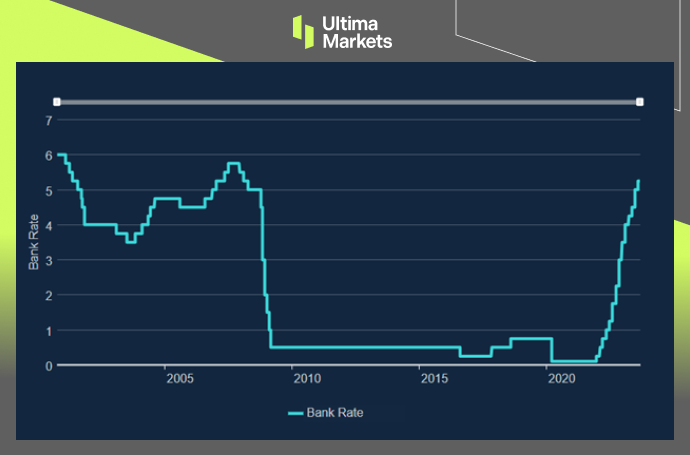

Bank of England Governor Andrew Bailey said at a Treasury Select Committee hearing on the 7th that the interest rate hike policy is close to the peak, and BoE’s Monetary Policy Committee will make another decision on September 21.

Britain’s annual inflation rate of 6.8 percent is higher than Prime Minister Rishi Sunak’s planned target of 5 percent by the end of 2023 and is the highest among G7 nations. The governor explained that due to the increase in crude prices, the inflation data in August may be slightly higher than expected. At the same time, he believes that inflation will be obvious by the end of this year, especially in autumn. In addition, he pointed out that the Monetary Policy Committee may finally vote in support of raising interest rates in September.

(Bank rate record, Bank of England)

The Bank of England released a monthly survey on the 8th, showing output prices are expected to increase by 4.9% in the next 12 months. The figure, based on a three-month rolling average, was down 0.5 percentage from July and well below last year’s peak of 6.6% in September. The outlook for wage growth has also dropped to an average of 5.1%, continuing a downward trend from a high of 6% in late 2022. The survey of recruiters points out a cooling labor market. The findings could slow the central bank’s pace of raising interest rates.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

外出先から市場をモニタリング

市場は需給変動の影響を受けやすい

高いボラティリティが魅力的

隠れた手数料のない、深く多様な流動性

ディーリングデスクやリクオートなし

Equinix NY4サーバー経由の高速執行