You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

Fewer S&P 500 Companies Citing “Inflation” in 2Q23 Conference Calls

トピックThrough Document Search, FactSet searched for the term “inflation” in the conference call transcripts of all the S&P 500 companies that conducted earnings conference calls from June 15 through September 7.

Of these companies, 296 cited the term “inflation” during their earnings calls for the second quarter. This is the lowest number of S&P 500 companies citing “inflation” on earnings calls going back to Q2 2021 (221). It also marks the fourth consecutive quarter in which the number of S&P 500 companies citing the term “inflation” has declined quarter-over-quarter. However, it should be noted that the number of S&P 500 companies citing “inflation” on earnings calls for Q2 2023 is still well above the 5-year average of 217 and the 10-year average of 168.

At the sector level, the Financials (49) and Industrials (46) sectors have the highest number of companies that cited “inflation” on earnings calls for Q2. However, the Consumer Staples (86%), Consumer Discretionary (76%), and Materials (76%) sectors have the highest percentages of companies that cited “inflation” on their Q2 earnings calls during this period.

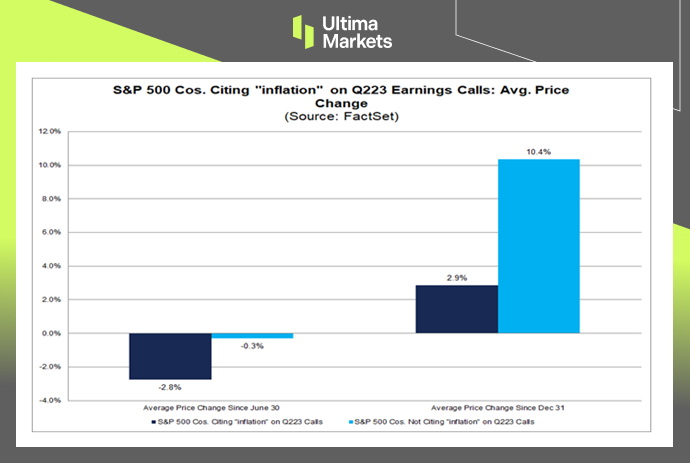

It is interesting to note that S&P 500 companies that cited “inflation” on Q2 earnings calls have seen a weaker average stock price performance in recent months compared to S&P 500 companies that did not cite “inflation” on Q2 earnings calls. For S&P 500 companies that cited “inflation” on Q2 earnings calls, the average change in price since June 30 is -2.8% and the average change in price since December 31 is 2.9%. For S&P 500 companies that did not cite “inflation” on Q2 earnings calls, the average change in price since June 30 is -0.3% and the average change in price since December 31 is 10.4%.

(Survey by FactSet)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

外出先から市場をモニタリング

市場は需給変動の影響を受けやすい

高いボラティリティが魅力的

隠れた手数料のない、深く多様な流動性

ディーリングデスクやリクオートなし

Equinix NY4サーバー経由の高速執行