Surging Inflation Sparks Concerns in South Africa, Reaches Five-Month High

TOPICSTags: South Africa, USDZAR

Inflation Rate Peaks in South Africa: A Detailed Exploration

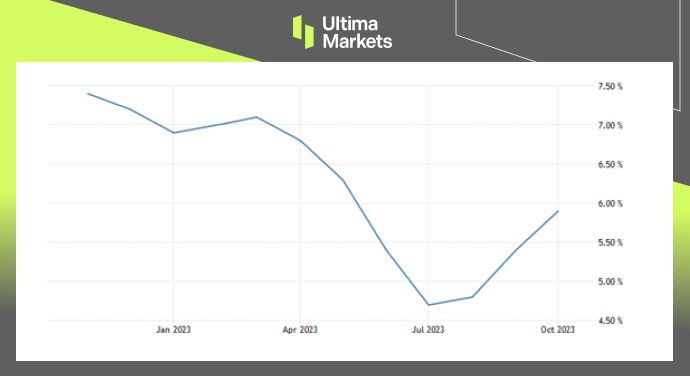

In October, South Africa witnessed a significant uptick in its inflation rate, scaling new heights at 5.9%. This surge, nearing the upper limit of the South African Reserve Bank’s targeted range, can be attributed to multiple factors.

Notably, elevations in food, transport, healthcare, and expenses related to restaurants and hotels played pivotal roles in propelling inflation to this five-month pinnacle.

(Inflation Rate, Statistics South Africa)

Economic Outlook and Influential Factors

South African Reserve Bank’s Targeted Scope

The inflationary surge brings into focus the critical role of the South African Reserve Bank (SARB) in managing economic stability. As inflation approaches the upper limit of the SARB’s targeted scope, concerns arise about the potential impact on interest rates and the overall economic outlook.

Analyzing Core Inflation Trends

While the overall inflation rate surged, core inflation, excluding volatile components like food and energy, took a divergent path. Core inflation witnessed a dip to a 14-month low, registering at 4.4%. This nuanced perspective sheds light on the underlying dynamics of inflation, highlighting the impact of specific sectors on the overall economic landscape.

Factors Influencing Exchange Rates and Interest Rates

South African Rand’s Response

Despite the weakening of the US dollar, the South African rand faced downward pressure, trading modestly lower around 18.5 ZAR per USD. Investors, attuned to signals of easing inflation, grappled with the prospect of interest rate cuts in 2024.

The delicate dance between the rand exchange rate and consumer inflation becomes a focal point for the South African Reserve Bank’s policy decisions.

(USD/ZAR One-month Chart)

SARB’s Policy Verdict

Anticipation looms over the upcoming South African Reserve Bank policy verdict, with analysts divided on the potential outcomes. A hawkish on-hold move is a prevailing prediction, considering the bank’s cautious approach in the face of inflation risks.

The decision to maintain rates at 8.25%/year in both the July and September monetary policy council gatherings underscores the SARB’s commitment to navigating economic uncertainties prudently.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2023 Ultima Markets Ltd. All rights reserved.

Pourquoi trader des métaux et des matières premières avec Ultima Markets ?

Ultima Markets offre l'environnement de coûts et d'échange le plus compétitif pour les matières premières les plus répandues dans le monde.

Commencer à traderSurveiller le marché en déplacement

Les marchés sont sensibles aux changements de l'offre et de la demande

Attrayant pour les investisseurs uniquement intéressés par la spéculation sur les prix

Liquidité profonde et diversifiée sans frais cachés

Pas de bureau de négociation et pas de requotes

Exécution rapide via le serveur Equinix NY4