Cisco’s Q1 2024: Exceeding Expectations in Earnings and Revenue

Cisco Systems (CSCO.US), a tech stock, performed exceptionally well in the first quarter, exceeding both revenue and profits projections. With an astounding $1.11 in profits per share (EPS), Cisco beat analyst estimates by a healthy $0.08.

Furthermore, the business’s sales of $14.7 billion above the $14.62 billion average expectation. This financial success demonstrates Cisco’s tenacity and reinforces its position as the industry leader.

Addressing Concerns: Navigating a Dip in New Product Orders

Despite the triumphant quarter, Cisco acknowledged a temporary slowdown in new product orders. The company attributed this dip to customer priorities, emphasizing the installation and implementation of products from previous quarters.

It’s crucial to note that while Cisco faced this challenge, the overall trajectory remains positive, underscoring the company’s confidence in its long-term strategy.

Strategic Acquisitions and Ambitious AI Goals

Cisco declared its desire to pay a significant $28 billion to purchase the renowned data analytics software provider Splunk, in a daring strategic move. This purchase demonstrates Cisco’s dedication to growing its capabilities in the rapidly changing technology industry.

CEO Chuck Robbins expressed confidence in Cisco’s potential to secure artificial intelligence infrastructure orders exceeding $1 billion from cloud providers in the 2025 fiscal year. Cisco’s flexibility in collaborations positions it strategically for sustained growth.

Navigating Challenges: Q2 2024 Guidance

Looking ahead, Cisco Systems provides guidance for the second quarter of 2024, projecting an EPS in the range of $0.82 to $0.84. This forecast, below consensus estimates of $0.99, signals potential challenges.

The company also anticipates Q2 revenue to be around $12.6 billion to $12.8 billion, missing the consensus estimate of $14.19 billion. While these projections pose challenges, Cisco remains resolute in adapting to market dynamics and maintaining a competitive edge.

Fiscal Year 2024 Outlook: Managing Investor Expectations

Cisco Systems projects EPS for the entire 2024 fiscal year to be between $3.87 and $3.93, which is just less than the $4.05. consensus expectation.

Furthermore, the business projects fiscal year sales of between $53.8 billion and $55 billion, which is less than the $57.76 billion average projection. As Cisco navigates these projections, investors keenly observe the company’s strategic responses to market shifts.

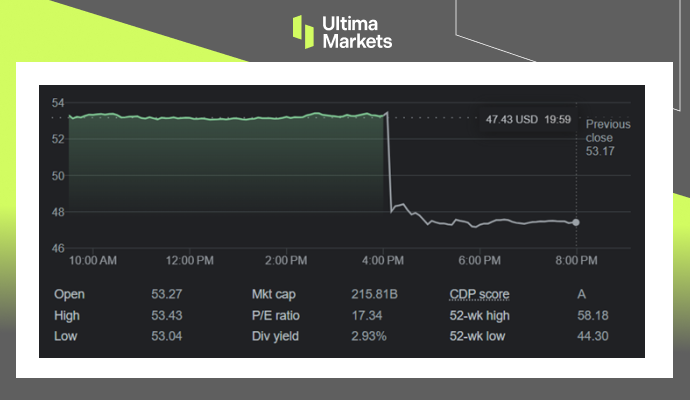

Share Price Impact: Responding to a Significant Downturn

In response to the guidance cuts and projections, Cisco’s stock experienced a notable downturn, with a more than 10% drop in Wednesday’s after-hours trading.

This decline underscores the market’s sensitivity to forward-looking statements, emphasizing the importance of transparent communication in managing investor expectations.

(Cisco Systems Stock Performance One-day Chart)

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2023 Ultima Markets Ltd. All rights reserved.

Pourquoi trader des métaux et des matières premières avec Ultima Markets ?

Ultima Markets offre l'environnement de coûts et d'échange le plus compétitif pour les matières premières les plus répandues dans le monde.

Commencer à traderSurveiller le marché en déplacement

Les marchés sont sensibles aux changements de l'offre et de la demande

Attrayant pour les investisseurs uniquement intéressés par la spéculation sur les prix

Liquidité profonde et diversifiée sans frais cachés

Pas de bureau de négociation et pas de requotes

Exécution rapide via le serveur Equinix NY4