As a mouthpiece of the Fed, the Jackson Hole Economic Symposium always attracts the eyeballs of numerous investors. Considering the current turbulent global economic situation, this year’s meeting is undoubtedly eye-catching. The three-day symposium officially ended in August, and the speeches of renowned financial names captured the world’s attention.

This article is going to unriddle hidden messages in speeches and help you get insight into future investment trends.

Fed message iterated and no rate cuts in sight

The spotlight at the meeting was the speech by Federal Reserve Chairman Jerome Powell. He patiently reiterated the importance of U.S. interest rate decisions on inflation: “The Federal Reserve’s responsibility is to reduce inflation to the 2% target. Although inflation has fallen from highs, it is considered too steep. The Fed will be prepared to raise interest rates further if necessary and keep restrictive policies going until it is confident that inflation will fall sustainably toward the target. ” From the words, the Fed still attaches great importance to achieving the inflation target, and it also greatly dispels market expectations for interest rate cuts.

Inflation downtrend becoming stagnant

Judging from the figures released, although the economy has slowed down somewhat, consumption seemingly remains intact. After falling from highs, price levels have entered a stagnant state. This phenomenon will undoubtedly arouse market concerns in the high-interest rate environment. The U.S. Department of Commerce reported on July 28th that the personal consumption expenditures (PCE) index increased by 3.0% year-on-year in June, slightly lower than market expectations of 3.1%. Food and energy prices are susceptible to fluctuations due to global factors, which may send misleading signals to the inflation outlook. Therefore, the Fed focuses more on core PCE inflation. Excluding food and energy prices, core PCE increased by 4.1% year-on-year in June, which was lower than market expectations of 4.2% and 4.6% of the previous value, the smallest increase since September 2021. The U.S. Department of Commerce announced on August 31 that PCE increased by 3.3% annually in July, in line with market expectations. The core PCE increased by 4.2% year-on-year in July, slightly higher than the 4.1% in June, but in line with market expectations.

(Core Personal Consumption Expenditure PCE Index, Investing.com)

Resilient labor market

In addition, the job market continues to remain resilient, indicating that the U.S. economy not heading for a recession. However, inflation seems to be difficult to decline further as a result. The U.S. Department of Labor announced that nonfarm payroll increased by 187,000 in July, slightly lower than market estimates of 200,000. Although the number missed expectations, it actually went up from the downward revision of 185,000 in June. The unemployment rate was 3.5%, while the market consensus expected the unemployment rate to remain stable at 3.6%. The unemployment rate is slightly higher than the lowest level since late 1969. The average hourly wages, the Fed’s compass for inflation, rose 0.4% for the month and at an annual rate of 4.4%. Both figures were 0.3% and 4.2% higher than their respective forecasts.

Consult history when observing reality, Reality does not exist without history

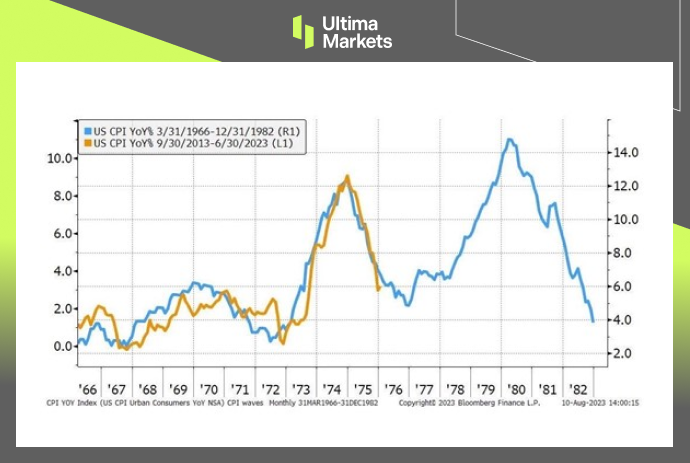

As we look for today’s answer from history, it is not difficult to discover the Fed’s concerns and why the chairman often adopts a reserved tone in his remarks. The long-run quantitative easing policy has made people accustomed to the low-interest environment. How did people deal with inflation? Is there a period in history that matches the present so that we can find clues? From the comparison of the diagram below, we can see that the yellow curve, representing CPI from 2013 to 2023, closely replicates the one dated 1966 to 1976 (blue line), with inflation rising sharply and then cooling down after being controlled. When the time sequence entered the late 1970s, the revolution in Iran caused tension in the oil market, and inflation soon reignited. The international crude oil price soared from about $15 per barrel in 1979 to doubling to $ 39 in February 1981. Price levels went skyrocketed. The late 70s CPI soared higher than the peak in 1974-75! Now, OPEC+ allies are implementing a voluntary production reduction policy until the end of the year in an attempt to deepen their operations in the oil market. As expected, oil prices have reached the year-to-date high of $90 per barrel at the beginning of autumn. Although economic data show inflation has cooled, history tells us it is hard to defeat. The oil cuts have fostered uncertainties on the path to winning the inflation battle. The Federal Reserve must stay alert and respond fast. Whenever there is an overly optimistic atmosphere in the market, the Federal Reserve will release a hawkish message to suppress it, conveying that interest rates must remain high and last longer. Its verbal warning works best when the global economic environment is fragile.

(US CPI YoY%, 1966-1982 Blue Line V.S. 2013-2023 Yellow Line)

Natural rate of interest possibly rises over time

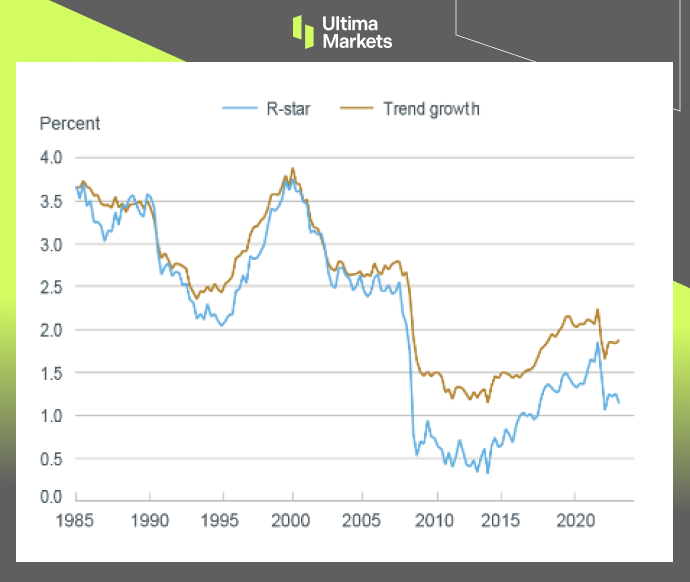

The natural rate of interest (r-star) has recently become a popularly debated topic among Fed officials, and some officials believe the neutral rate of interest might have gone up. The r-star is the real interest rate set by the central bank to keep the economy operating at full employment and price stability. Simply saying, at the neutral interest rate, the economy is neither expanding nor contracting. According to data from the Federal Reserve Bank of New York, r-star has been between 2.0% and 3.5% from 2000 to 2009 and remained near 1.0% since then. The Federal Reserve Bank of New York estimates that the current r-star hovers between 0% and 0.5%. Without the monetary easing policy, the U.S. economy seems to be intact and still running well in a relatively high interest-rate environment. Does this mean that the neutral interest rate has already quietly rebounded? However, the neutral interest rate has always been an abstract observation tool, which is not easy to measure and can only be reviewed after the fact occurs. With the uprise of the new economy and geopolitical risks, the Federal Reserve’s mission has become more complex, and monetary policy must become innovative and not limited to interest rate setting. What is certain is that the market’s desire to return to the ultra-low interest times of the past no longer exists.

(Natural rate of interest r-star, Fed NY)

Summary

As Powell said, the Fed still needs to work harder to bring inflation down to 2% sustainably, and this may require two conditions: A period of low economic growth and a cooling labor market. Speaking of economic growth, GDP growth in 1H23 is higher than the long-term trend, and recent consumption data has also been particularly strong. As for the labor market, it has been rebalancing over the past year.

Therefore, monetary policy needs to remain flexible. It is expected that interest rates will be raised again in September or November, while the interest rate cut expected by the market may have to wait until the second half of 2024. According to FedWatch, CME Group’s interest rate forecast tool, after Jackson Hole, the probability that the Fed will not raise interest rates in September has risen to 88.5%. Certainly, we cannot rule out the possibility that unexpected situations may occur, resulting in the Fed eventually raising interest rates in September.

Disclaimer

The comments, news, research, analyses, prices, and all information contained in this article can only be regarded as general information and are provided only to help readers understand the market situation and do not constitute investment advice. Ultima Markets has taken reasonable steps to provide up-to-date information, but cannot guarantee the accuracy and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Pourquoi trader des métaux et des matières premières avec Ultima Markets ?

Ultima Markets offre l'environnement de coûts et d'échange le plus compétitif pour les matières premières les plus répandues dans le monde.

Commencer à traderSurveiller le marché en déplacement

Les marchés sont sensibles aux changements de l'offre et de la demande

Attrayant pour les investisseurs uniquement intéressés par la spéculation sur les prix

Liquidité profonde et diversifiée sans frais cachés

Pas de bureau de négociation et pas de requotes

Exécution rapide via le serveur Equinix NY4