Watch out for ECB Lagarde’s words

At last, the euro has shrugged off bad economic news and inflation has come under control. It might be the time for ECB to reconsider its tightening monetary policy . Investors will focus on whether the European Central Bank will pause interest rate hikes in September as expected.

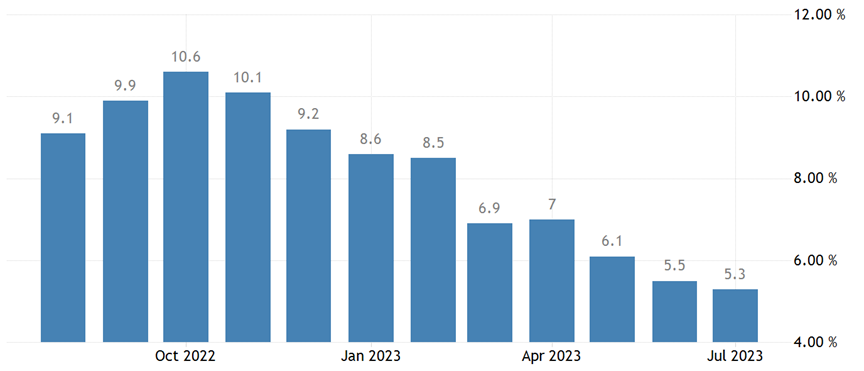

(Inflation rates in the euro zone in the past year)

ECB’s Dilemma: To Hike or Not to Hike

The August PMI report due on Wed. is going to be in the spotlight. Forecasts show the manufacturing sector slumps further, and start to take a toll on services sector, endangering the euro zone economy.

With sluggish numbers, the ECB could take a break in September rate hike, however, the euro might receive a hit. Most economists believe the ECB will pause rate hikes in September but see room for an increase before the end of 2023 amid rising inflation.

Lagarde’s Utterances: A Market Barometer

Separately, at the Jackson Hole Global Central Bank Economic Symposium on Saturday, European Central Bank President Lagarde’s speech is going to be very important. Investors will look for clues from the review.

U.S. Economic Resilience

Based on data released in the past week, the US economy continued to maintain a strong momentum. Retail sales and manufacturing figures unexpectedly rose as residential numbers climbed. The strength of the U.S. dollar has caused the euro to remain in a downward trend.

(EUR/USD daily cycle, Ultima Markets MT4)

July 4th represents a turning point at present. If it is broken, the upward momentum will subside, leaving little hope for EUR/USD to stage a rebound.

Market Volatility: The Lagarde Effect

It is worth noting that the overall volatility of the euro against the US dollar has slowed down significantly. Both the overall volatility on the chart and the average level of the 200 -period ATR indicators are declining. As a result, Lagarde’s speech is going to shift the market volatility.

Conclusion

In conclusion, as we navigate the complex web of economic variables, ECB President Lagarde’s words loom large on the horizon.

The ECB’s delicate balancing act and the resilient U.S. economy have set the stage for a captivating narrative in the world of finance.

For investors and market participants, astutely decoding the signals emanating from these developments will be essential in making informed decisions.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Warum mit Ultima Markets Metalle und Rohstoffe handeln?

Ultima Markets bietet das wettbewerbsfähigste Kosten- und Börsenumfeld für gängige Rohstoffe weltweit.

Mit dem handel beginnenÜberwachung des Marktes von unterwegs

Märkte sind anfällig für Veränderungen in Angebot und Nachfrage

Attraktiv für Anleger, die nur an Preisspekulationen interessiert sind

Umfangreiche und vielfältige Liquidität ohne versteckte Gebühren

Kein Dealing Desk und keine Requotes

Schnelle Ausführung über den Equinix NY4-Server