Understanding India’s Industrial Growth Dynamics

THEMENTags: India, Industrial Production, Rupee, USD/INR

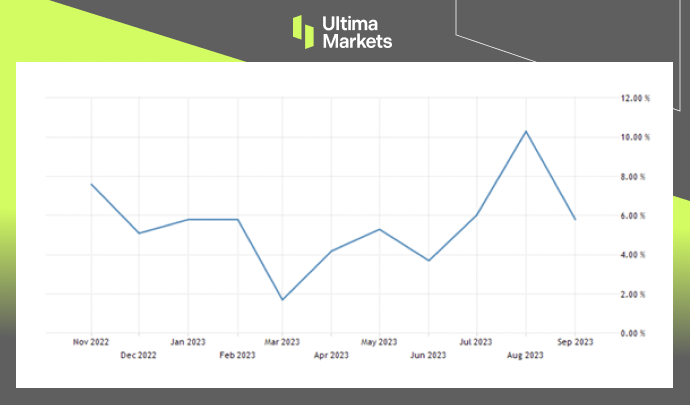

Industrial Growth in India Decelerated to 5.8% in September, Marking a Three-Month Low Compared to 10.3% in August

In the realm of economic fluctuations, India stands as a significant player, showcasing its industrial prowess amidst a landscape shaped by various factors.

Recent statistical revelations have illuminated the nuances of the country’s industrial growth, marking a shift in trajectory.

Deceleration in Growth: Unraveling the Numbers

The Ministry of Statistics & Programme Implementation (MOSPI) recently disclosed a notable deceleration in India’s industrial growth, registering a 5.8% year-on-year expansion in September.

This marked a notable decline from the robust 10.3% witnessed in the preceding month of August, signifying a trend change.

This deceleration primarily found its roots in the manufacturing sector, a pivotal pillar in India’s industrial landscape.

(India Industrial Production, MOSPI)

Manufacturing Sector: A Key Player

The heartbeat of India’s industrial landscape, the manufacturing sector, underwent a 4.5% increase in output in September 2023, showcasing a notable surge from the 2.0% growth reported in the same period last year.

However, August’s buoyant growth, boasting a 9.3% increase, contrasted starkly against September’s tempered surge, outlining a clear trajectory shift.

Dissecting Sectoral Performance

Delving deeper into the fabric of industrial domains, the mining and electricity sectors portrayed a story of their own. The mining sector witnessed a 11.5% year-on-year growth in September, a tad lower than the 12.3% observed in August.

Similarly, the growth in electricity output decelerated to 9.9% in September, down from the substantial 15.3% recorded in the preceding month.

Causal Threads: Festivals and Weather Conditions

The festive calendar, a celebrated facet of Indian culture, intertwined with adverse weather conditions, emerged as pivotal factors contributing to the substantial easing observed across sectors.

These elements, intrinsic to the social and climatic fabric of the nation, influenced the industrial output significantly.

Currency Dynamics: The Tale of the Indian Rupee

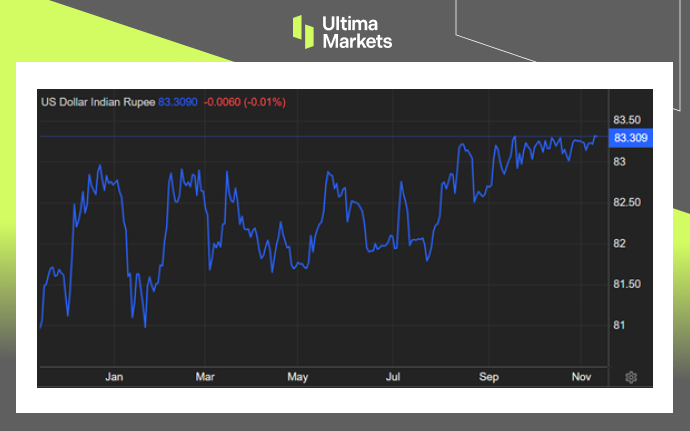

Simultaneously, the Indian rupee experienced a fluctuating trajectory, edging closer to a record low against the USD.

Sustained capital outflows from the Indian economy contributed to this, prompting the Indian rupee to depreciate beyond 83 per USD in November.

The Reserve Bank of India’s proactive stance, selling foreign exchange reserves to prevent further devaluation, played a pivotal role in maintaining a delicate balance.

(USD/INR 1-year Chart)

The Reserve Bank’s Role: A Balancing Act

The RBI’s consistent sale of foreign exchange reserves, totaling over $23 billion in the past four months, illustrates the active role played in stabilizing the Indian rupee’s value.

This strategic move has curbed excessive bearish positions on the currency, sustaining a delicate equilibrium amidst global economic ripples.

Navigating the Industrial Seas Ahead

As India charts its economic trajectory, acknowledging the impact of festivals, climatic variables, and global economic dynamics remains imperative. The interplay of these elements, intertwined with the resilience and adaptability of its industrial landscape, will shape the nation’s growth story.

In conclusion, India’s industrial growth paints a narrative of resilience amidst evolving circumstances, embodying a blend of challenges and strategic maneuvering to maintain equilibrium and foster sustainable growth.

Warum mit Ultima Markets Metalle und Rohstoffe handeln?

Ultima Markets bietet das wettbewerbsfähigste Kosten- und Börsenumfeld für gängige Rohstoffe weltweit.

Mit dem handel beginnenÜberwachung des Marktes von unterwegs

Märkte sind anfällig für Veränderungen in Angebot und Nachfrage

Attraktiv für Anleger, die nur an Preisspekulationen interessiert sind

Umfangreiche und vielfältige Liquidität ohne versteckte Gebühren

Kein Dealing Desk und keine Requotes

Schnelle Ausführung über den Equinix NY4-Server