In this comprehensive analysis, Ultima Markets brings you an insightful breakdown of the USDJPY for 14th November 2023.

Key Takeaways

- The widening interest rate gap is the fundamental factor: On October 31, the Bank of Japan further relaxed its control on government bond yields, while the Federal Reserve still has the possibility of raising interest rates. The policy interest rate gap between the two continues to widen, causing the Japanese yen to fall into a continued depreciation trend.

- Carry trade is a booster: The interest rate differential between the two countries and the recent continued low volatility of the yen also encourage carry trade. It is a strategy of selling low-interest Japanese yen funds in exchange for high-yielding currencies. This is a contributing factor that keeps the yen under pressure.

- The Japanese yen unexpectedly surged: The Japanese yen unexpectedly surged during the U.S. trading session yesterday, which once made the market think that the Bank of Japan had intervened. However, according to the current news, it may be an appreciation fluctuation caused by the adjustment of Japanese yen options positions. Previously, when asked whether he was prepared to intervene in the foreign exchange market or take other measures to curb the yen’s decline, Japan’s top monetary official Masato Kanda said that the authorities “are on standby.”

- Frightened Japanese Yen: If the U.S. economic data released this week is good, the Fed’s suspense about raising interest rates will remain. This could push USD/JPY towards the 152 range. However, the continued depreciation of the yen will make the market continue to be wary of the intervention of the Bank of Japan. Once there are signs of appreciation of the yen, the withdrawal of profit-making positions and traders preparing to go long yen on the sidelines will cause the dollar to experience a rapid downward trend against the yen.

Technical Analysis

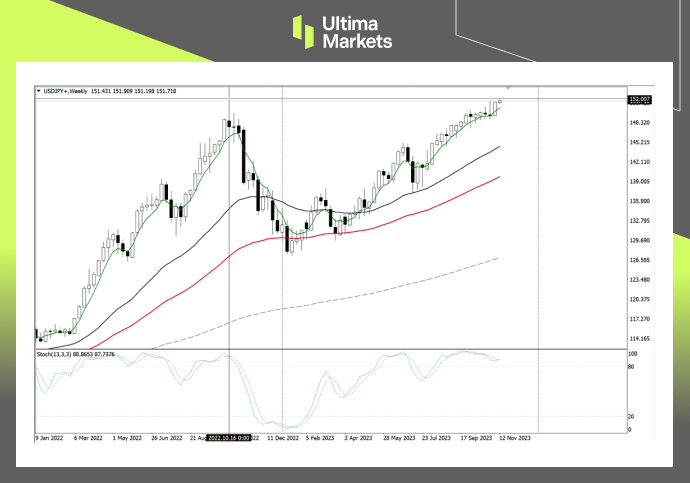

Weekly Chart Insights

- Stochastic Oscillator: The indicator has entered the oversold range, and the selling pressure is serious. You need to be alert to the coming of a short-term intraday rebound in the market.

- Moving average: After the 5-day moving average completely fell below the 200-day moving average, the market did not show an effective rebound structure, and the two consecutive days of decline may take some time to correct. The rebound target price is looking towards the 5-day moving average.

1-hour Chart Analysis

- Stochastic oscillator: The indicator has sent a long signal, and oil prices have a certain rebound momentum. However, oil prices cannot rebound lightly until they break through the 81.316 level.

- Price Action: Oil prices are currently in a strong downward trend, and you cannot arbitrarily choose to enter the market at the bottom. Although the current indicators are suggesting that a rebound is imminent, we need to wait for a clear bullish structure before making a correction.

Pivot Indicator

- According to the pivot indicator in Ultima Markets MT4, the central price of the day is established at 81.178,

- Bullish Scenario: Bullish sentiment prevails above 81.178, first target 82.268, second target 83.852;

- Bearish Outlook: In a bearish scenario below 81.178, first target 79.594, second target 78.519.

Conclusion

To navigate the complex world of trading successfully, it’s imperative to stay informed and make data-driven decisions. Ultima Markets remains dedicated to providing you with valuable insights to empower your financial journey.

For personalized guidance tailored to your specific financial situation, please do not hesitate to contact Ultima Markets.

Join Ultima Markets today and access a comprehensive trading ecosystem equipped with the tools and knowledge needed to thrive in the financial markets.

Stay tuned for more updates and analyses from our team of experts at Ultima Markets.

—–

Legal Documents

Ultima Markets, a trading name of Ultima Markets Ltd, is authorized and regulated by the Financial Services Commission “FSC” of Mauritius as an Investment Dealer (Full-Service Dealer, excluding Underwriting) (license No. GB 23201593). The registered office address: 2nd Floor, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius.

Copyright © 2023 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Warum mit Ultima Markets Metalle und Rohstoffe handeln?

Ultima Markets bietet das wettbewerbsfähigste Kosten- und Börsenumfeld für gängige Rohstoffe weltweit.

Mit dem handel beginnenÜberwachung des Marktes von unterwegs

Märkte sind anfällig für Veränderungen in Angebot und Nachfrage

Attraktiv für Anleger, die nur an Preisspekulationen interessiert sind

Umfangreiche und vielfältige Liquidität ohne versteckte Gebühren

Kein Dealing Desk und keine Requotes

Schnelle Ausführung über den Equinix NY4-Server