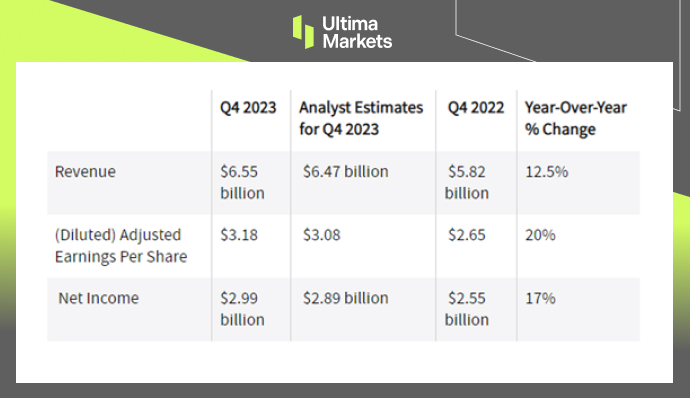

During the final quarter of last year, Mastercard (MA.US) exceeded forecasts, recording a 20% growth in adjusted earnings per share, reaching $3.18, while revenue also experienced a boost of 12.5%, amounting to $6.55 billion. This solid growth for the company is a repetition of the previous quarter. The consistent consumer spending, robust cross-border volumes, a wider payments network, and supplementary services have all contributed to Mastercard’s success. Nonetheless, operational costs somewhat reduced the positive turn.

(Mastercard 4Q23 Earnings)

For 2023, Mastercard reported a healthy profit of $11.2 billion which translates to an earnings per share of $11.83. Their yearly revenue ascended to a whopping $25.1 billion.

Looking forward, Mastercard predicts the net revenue growth for the first quarter of 2024 to reach low double digits, and projects a marginal growth in operating expenses from the year before. For the entire 2024, management expects low double-digit expansion in net revenue from its $25.1 billion mark in 2023. The company expects a moderate single-digit increase in operating costs above the $11.1 billion of 2023. The optimistic forecast mirrors Mastercard’s positive trajectory, undeterred by potential macroeconomic challenges.

(Mastercard Stock Performance Six-month Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server