German Economy Slips into Technical Recession, Stock Market Hits and Maintains Highs

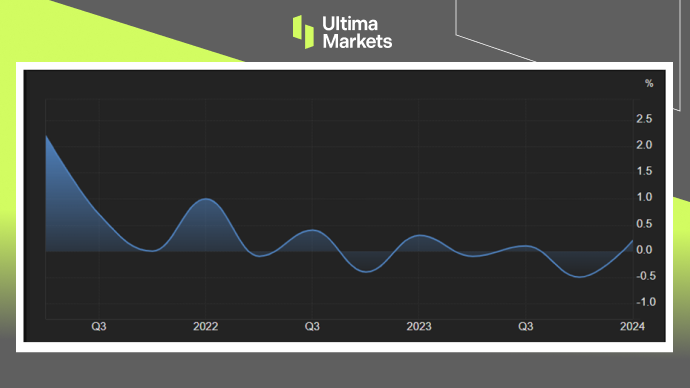

TOPICSGermany’s first-quarter GDP witnessed a modest recovery, with a 0.2% quarter-on-quarter expansion, bouncing back from a 0.5% contraction in the preceding quarter. The rebound aligned with preliminary estimates and market expectations.

The upturn was primarily driven by a sharp resurgence in gross fixed capital formation, which rose by 1.2% compared to a 2.1% decline in the fourth quarter of the previous year. Positive momentum was largely attributable to a robust increase in construction investments. Additionally, net external demand made a favorable contribution to GDP growth, as exports advanced by 1.1%, contrasting with a 0.9% decline in the previous quarter, while imports rose at a more moderate rate of 0.6%, compared to a 1.6% decline in the prior period.

Conversely, private consumption and government spending experienced a 0.4% decline during the period. On an annual basis, the economy contracted by 0.2%, unchanged from the previous period, marking the country’s entry into a technical recession for the first time in over three years.

(GDP Growth Rate QoQ%,Federal Statistical Office of Germany)

The DAX index overcame early declines and concluded the trading session flat at 18,693 on Friday. This outcome translated into a sideways movement for the week, positioning the index merely 1% away from the previous week’s record high.

Markets continued to evaluate the economic landscape and its potential impact on the European Central Bank’s policy stance after June. Robust economic activity and persistent inflation, both domestically and across the Eurozone, as evidenced by the PMI data released during the previous session, diminished the urgency for the ECB to lower borrowing costs.

The financial sector spearheaded gains during the session, with Munich RE and Deutsche Bank each posting increases exceeding 1%. Additionally, heavyweight automobile manufacturers halted their selling pressure from earlier in the week, as Mercedes, Volkswagen, and Porsche finished firmly in positive territory. Conversely, SAP and Infineon trimmed their gains from the previous day, declining 0.7% and 0.3%, respectively.

(DAX Index Yearly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server