On Tuesday, Reserve Bank of Australia’s Head of Economic Analysis Marion Kohler during his speech reiterates that while inflation has cooldown slightly, it is still hovering at elevated levels. He added that it would take some time for inflation to return to their target of 2-3% which is dependent on economic progression.

During the conference, Kohler also mentioned that he does not expect inflation to depreciate to their target until next year, due to subdued economic growth both domestic and global.

Last week, the central bank held its interest rates unchanged at 12-years high of 4.35%, citing possibility for more rate hikes if necessary. During the policy meeting, RBA trimmed its economic forecast, largely due to weak consumption, elevated debt cost and signs of easing in the employment market.

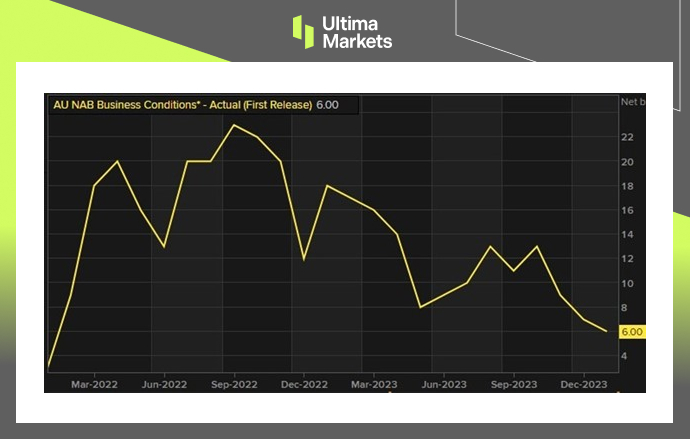

(Australia Business Conditions overview)

From economic front, Australia’s business conditions weakened further for the month of January, led by the slowdown in services sector. The data released by National Australia Bank shows business conditions slump to +6, below its average of +7. As of writing, AUD/USD was down 0.06% to 0.6526.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server