Moderating Core Inflation in November Bolsters Expectations of a Dovish Shift by the Federal Reserve

In November 2023, the United States experienced an unexpected twist in the Personal Consumption Expenditure Price Index (PCE), showing a 0.1% month-over-month decline. This downturn, contrary to anticipated stability, marked the first decrease in PCE prices since February 2022.

The primary driver behind this shift was a 0.7% decrease in prices for goods, offsetting a 0.2% increase in services. This change is significant, as the PCE index is renowned for capturing inflation trends across a wide spectrum of consumer expenses and reflecting shifts in consumer behavior.

Core PCE and Federal Reserve Insights

Steady Core PCE

The core PCE inflation, a crucial metric excluding food and energy, held steady at 0.1% in November, following a downward revision in October. The Federal Reserve considers core PCE a preferred measure of inflation, highlighting its stability as a key economic indicator.

Energy and Food Impact

Analyzing specific sectors, the energy index experienced a noteworthy decline of 2.7% month over month, while the food measure showed a marginal decrease of 0.1%. These fluctuations contribute to the broader understanding of inflationary dynamics.

Annual Rates Adjustment

The annual PCE inflation rate cooled to 2.6%, reaching its lowest point since February 2021, down from 2.9% in October. Simultaneously, the annual core inflation rate experienced a slowdown, dropping to 3.2% from 3.4%, marking its lowest point since mid-2021.

(PCE Index, The Bureau of Economic Analysis)

Market Impact and Currency Relations

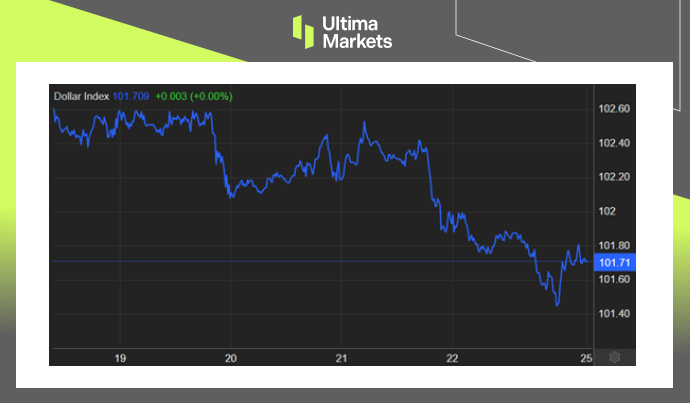

Despite these notable shifts in inflation, the latest data does not seem to be substantially impacting the value of the US dollar against other major currencies. At the time of publication, the US dollar index, measuring the greenback against a basket of other currencies, showed a modest decline of 0.13% to 101.65.

(Dollar Index One-week Chart)

Frequently Asked Questions

Q1: What is the PCE Price Index?

A1: The PCE Price Index measures the prices people in the United States pay for goods and services, capturing inflation across various consumer expenses.

Q2: How does Core PCE differ from the regular PCE?

A2: Core PCE excludes food and energy, providing a more focused measure of inflation and is preferred by the Federal Reserve as an economic indicator.

Q3: Why is the Federal Reserve concerned about inflation rates?

A3: Inflation rates impact economic stability and purchasing power; the Federal Reserve monitors these rates closely to make informed monetary policy decisions.

For more detailed information, you can visit the official Bureau of Economic Analysis website.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4