ISM Manufacturing PMI Falls Short of Expectations

In November 2023, the Institute of Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) maintained its position at 46.7, mirroring the October reading and falling short of economists’ expectations set at 47.6. This steady figure underscores the persistent challenges faced by the manufacturing sector, signaling ongoing contractionary pressures.

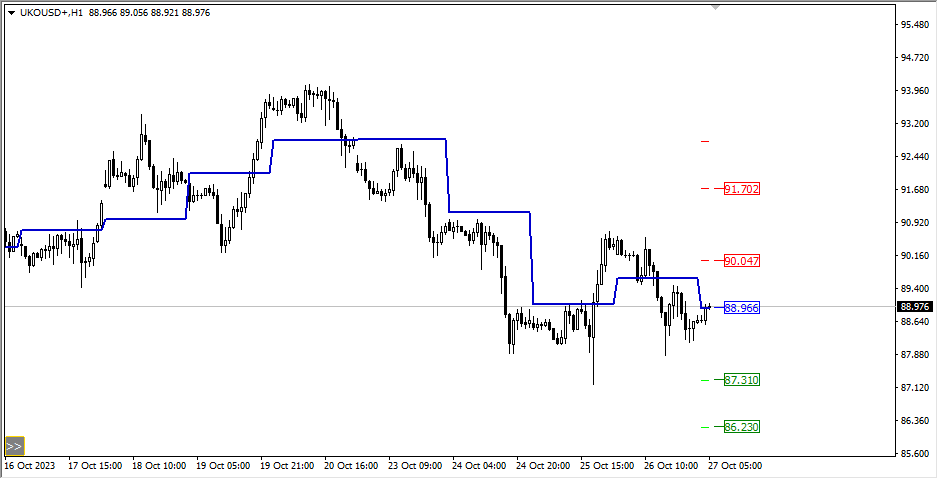

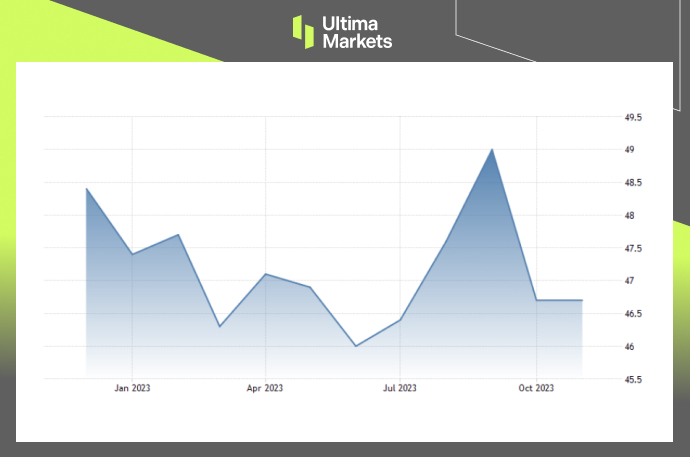

(Purchasing Managers Index PMI,ISM)

ISM Manufacturing PMI Key Metrics Overview

Production Index: A Deteriorating Landscape

The production index, a crucial indicator of manufacturing health, witnessed a decline into contractionary territory at 48.5, down from October’s 50.4. This downturn suggests a concerning shift in the manufacturing landscape, with implications for overall economic activity.

Employment Index: Quickening Job Losses

The employment index dipped to 45.8 from 46.8 in the preceding month, indicating an acceleration in job losses within the manufacturing sector. This trend is a critical factor affecting both the industry and the broader labor market.

Supplier Deliveries Index: Prolonged Contraction

The Supplier Deliveries Index slid for the 14th consecutive month to 46.2 from 47.7, portraying an environment where deliveries from suppliers are accelerating as demand weakens. This ongoing contraction underscores challenges in the supply chain.

New Orders and Inventories: Contractions with a Silver Lining

While new orders and inventories remained in contraction, there is a glimmer of positivity. New orders increased to 48.3 in November from 45.5 in October, and inventories rose to 44.8 from 43.3. This slower pace of decline suggests a potential stabilization in demand.

Prices Paid Index: Moderation Amidst Volatility

The prices paid index experienced a moderate uptick to 49.9 from 45.1, indicating some moderation and stability in manufacturing input prices. This is attributed to easing energy markets, although challenges persist due to rising steel prices.

Forward-Looking Insights

Manufacturing lead times continue to compress, signaling potential improvements in future conditions. Shorter lead times generally indicate enhanced efficiency in securing inputs and delivering finished products.

However, despite these positive indicators, the manufacturing sector remains entrenched in a significant downturn, as highlighted by the latest PMI data.

ISM Manufacturing PMI Future Outlook

The duration of these challenging conditions hinges on global demand stabilization and the trajectory of energy and commodity prices.

The manufacturing sector’s revival is contingent on broader economic factors, emphasizing the interconnectedness of global markets.

Frequently Asked Questions

Q1: What does the ISM Manufacturing PMI measure?

A1: The ISM Manufacturing PMI is a key economic indicator that gauges the health of the manufacturing sector based on factors such as production, employment, supplier deliveries, new orders, inventories, and prices paid.

Q2: Why is the November 2023 PMI figure significant?

A2: The November 2023 PMI figure of 46.7 is crucial as it indicates the persistent challenges and contractionary pressures faced by the manufacturing sector, reflecting on the overall economic landscape.

Q3: What factors contribute to the manufacturing sector’s downturn?

A3: Factors include declining production, accelerated job losses, prolonged contraction in supplier deliveries, and challenges in managing input prices amidst volatile energy and commodity markets.

Bottom Line

In conclusion, the November 2023 ISM Manufacturing PMI report provides a detailed snapshot of the challenges and nuances within the sector.

The intricate analysis of key metrics offers valuable insights for industry stakeholders and policymakers alike as they navigate the complex landscape of manufacturing in the United States.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4