Comprehensive USDX Analysis for December 8, 2023

In this comprehensive analysis, Ultima Markets brings you an insightful breakdown of the USDX for 8th December 2023.

USDX Key Takeaways

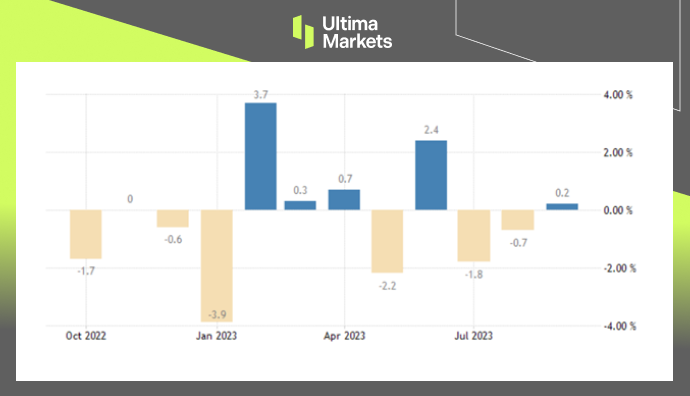

- Unemployment data: The number of initial jobless claims rose to 220,000 in the week as of December 2, slightly lower than the expected 222,000. The number of continuing jobless claims fell to 1.86 million in the week ending November 25, the largest drop since July and the second decline since early September.

- NFP is coming: The market currently expects non-farm employment to increase by 180,000, but the market has fully priced in the Fed’s interest rate cut in March next year. The increase of 180,000 may not be enough to prompt further rate cuts.

USDX Technical Analysis

USDX Daily Chart Insights

- Stochastic Oscillator: After the indicator sent out a long signal, it went up all the way, and the market price also started an upward trend, suggesting that short-term bulls have the upper hand and the bears is still not yet in place.

- Alternative trend line: An alternative trend line is drawn starting from the low point in April this year. The market has repeatedly been blocked and fluctuated on this trend line. Recently, the price has once again reached the trend line, which is also around the red 33-day moving average. Be wary of the market being blocked and going down nearby.

USDX 1-hour Chart Analysis

- Stochastic oscillator: The indicator sends a long signal, and at the same time forms a bottom divergence pattern in conjunction with the market price, suggesting that the market will further rebound upward.

- Fibonacci retracement level: Based on the downward trend since December 6, if the exchange rate rebounds further, it will look towards the 61.8% Fibonacci retracement level, which is also near the 33-period moving average.

Ultima Markets MT4 Pivot Indicator

- According to the pivot indicator in Ultima Markets MT4, the central price of the day is established at 103.653,

- Bullish Scenario: Bullish sentiment prevails above 103.653, first target 104.098, second target 104.605;

- Bearish Outlook: In a bearish scenario below 103.653, first target 103.142, second target 102.698.

Conclusion

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4